Investing and trading was once thought to be the sector only for experienced business professionals. As the financial regulatory laws keep updating, a minor is eligible to open a Demat account with the help of a legal guardian.

A digital financial background helps investors in opening a Demat account for a minor and can be highly beneficial. A trader understands the power of investing early and the exponential return that is valuable for shielding long-term investments and diversifying your portfolio in the cybersecurity landscape.

In this article, we are sharing all the eligibility details that are necessary for processing a minor Demat account and how to utilize them for a child’s secure future.

What is a Demat Account?

A Demat account allows holding shares and securities in electronic form. It allows the investors to buy and hold shares in it; not only this, but it also holds all investments made by an individual in shares, ETFs, government securities, crypto trading, and mutual funds in one place.

The Indian stock market went through a digitization process through Demat and enforced better and enhanced governance by SEBI. Moreover, it reduces the risk of storage damage, theft, and malpractice by securing confidential reports in electronic format. Opening up a Demat account also makes it easy to access the trading market and apply crypto trading strategies.

Earlier, the account opening process was manual, and it took ages to get it activated, but now anyone can have a Demat Account within 5 minutes. Even the pandemic worked as a catalyst, and many people got involved in exploring trading strategies.

What is a Minor Demat Account?

A minor Demat account is the same as any savings or current ledger except that it is procured under the name of the applicant, which means someone less than 18 years old.

The guardian can operate the account till the adolescent turns 18, and after that, it can be converted to a standard Demat account.

DO YOU KNOW?

There is no minimum amount or balance requirement for a Demat account. You can keep it empty or store all financial assets to be utilized when necessary.

Eligibility Criteria for a Minor Demat Account

Opening the Demat account for a minor is similar to any other one for an adult. There aren’t any age barriers, as the documents required to procure it are as such:

- He/She should be a resident of India.

- He/She should have a PAN card and Aadhaar Card certificates.

- He/She should have a bank account.

Since all of these criteria can be fulfilled without any age barrier, anyone can open such a bank ledger as long as they can produce proof of identity and address.

Documents Required for Opening a Minor Demat Account:

The following are the required documents before a minor Demat account is processed:

- Pan Card

- Address Proof

- Bank Proof

- Guardian Address Proof

- Guardian Pan Card

The broker can ask for a few more documents such as the applicant’s Birth Certificate, photographs, etc. All these documents are relevant for a minor Demat account till the adolescent turns 18.

Once the applicant turns 19, they will get a notification from the stockbroker and Depository for the conversion to the standard one.

The same documents such as an updated PAN card, address proof, bank statements, and photographs will be asked to be procured again for the process. After registration, your minor Demat account will be converted into a standard one.

In the meantime, it is always helpful to learn about easy and effective trading strategies to understand how they work.

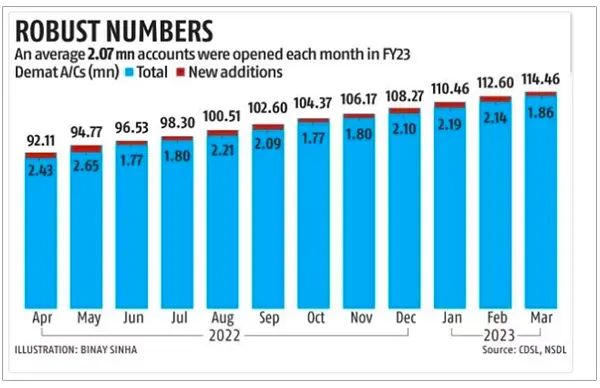

A recent survey indicates that despite the increasing interest rates, the market showed a steady rise in the opening of new Demat accounts from 2022 to 2023, as shown in the graph below.

Process of Opening a Minor Demat Account

Here is a step-by-step guide about the entire process to procure a minor Demat account easily.

- First, fill out the KYC form with all identification procedures.

- Opt for a good stockbroker.

- Make sure they have a minor Demat account feature.

- Registering for it and start doing all the due diligence such as filling out forms, providing documents, and getting them verified.

When opening an account for someone who is under 18, everything is done in their name, but the guardian also has to go through a KYC process to complete registration.

It is known as dual KYC, where all the information of both child and guardians will be submitted with photographs and signatures.

Creating a Demat account for your child can be highly lucrative as you are ensuring the finances for the future. It will also be beneficial to teach the kid about the wondrous world of the stock market. This would help your child in exploring the world of demat trading and prepare them for future trends in automated trading at a young age. And can learn about how to save money, invest that money, and create more money.