Trading is a complicated task to do. There are various factors and elements involved that can affect the highly volatile market to a great extent. Just like any other activity from our daily lifestyle, there are some signs and indications that can signal you to help predict the future.

If you understand them correctly, you can become the king of the fortune. But one small mistake on the other side can make you fall into the pit of losses. This high risk can be eliminated by simple measures and decisions that you take. Therefore, being your best friend for life, we are here present in front of you with some of the most famous trading strategies for managing risk.

1% Rule

There is no doubt in the fact that trading and investing involve high risks. Therefore, you should make yourself tough enough and mentally prepared before laying your first step into the market. The most effective and general rule for this calculation is the 1% rule. This rule teaches us that you should never invest more than 1% of the total amount present in your trading account. For instance, If you have $1000 in your account, the amount you are going to put into a trade should not exceed $10.

Some crazy investors who are enthusiastic enough to take higher risks for the sake of huge returns place their bets on 2%. But as we are here to discuss the strategies to minimize the risk on trading, we are going to stick with a single percent of the amount. Follow the article ahead to learn more interesting thumb rules just like this one.

Stop Loss and Take Profits Points

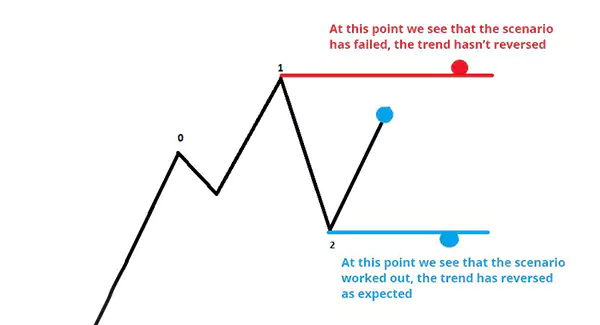

Stop-loss and Take-Profits Points are fun and interesting strategies to get your stakes sold on a particular point. To understand this better, a Stop-loss point is set up by a trader for those situations when the trade is going on a continuous decline.

Have you ever encountered a situation in which your stake is declining, and you are in hope that it will rise up soon? Well, the clock ticks, and you end up bearing a huge loss in the hope that one day it will get up. To eliminate this risk and run a viable trading bet, traders put a stop-loss point where your stakes will automatically get sold to face no further loss.

Just contrary to that, a Take-profit point is a point where you set up a limit to sell your stake. When you are pretty sure that X amount will be the highest it will grow and you are satisfied with that bet, you set your point there and whenever your trade reaches that point, it automatically gets sold at the price you agreed.

Calculating Expected Returns

Just like setting Stop Loss and Take Profit points, calculating expected returns is a significant thing to do in order to minimize the risk. As you can tell by the name, calculating expected returns gives an idea and help you predict the future and the results you might get with them. It will guide you in making rational and fair decisions that will affect your portfolio only for good.

Well, there is a proper formula curated to calculate the returns:

[(Probability of Gain) x (Take Profit % Gain)] + [(Probability of Loss) x (Stop-Loss % Loss)]

Even if you are not a pioneer in mathematics, with simple calculations and the right logic, this formula can help you with near-to-same results. If you are an active trader, it becomes necessary for you to track your records and measure your decisions so that you can bear as low losses as possible.

Wrapping Up

Trading is not an easy and risk-free market. As an active trader, you should know about these basic and effective strategies that can help in reducing the risk involved in it. Your hard-earned money should grow continuously and be kept safe with as low risk as possible. By taking these strategies into practice, like the 1% rule, Stop-Loss, and Take-Profit Points, and calculating expected return, you can do so on your own.

It is true that you should consult a financial expert at first, but as you spend time in this market, it becomes essential for you to learn about it so you can stand on your own.