If investing and trading in financial markets, diversification is a key strategy that can help reduce risk and enhance potential returns.

One way to achieve diversification is by using multiple trading brokers in the cybersecurity landscape.

At this point, it’s vital to address the fact that cybersecurity is one of the necessary aspects of financial well-being.

In this blog post, we will explore the benefits of diversifying your portfolio with multiple trading brokers and provide some tips on how to do it effectively.

Why Diversify with Multiple Trading Brokers?

Diversifying your portfolio with multiple trading brokers can provide several advantages:

Risk Mitigation

One of the primary reasons behind diversifying your portfolio is to mitigate risk and reduce the impact of cyber threats.

Different brokers may have varying levels of exposure to market events and risks. By spreading your investments across multiple brokers, you can reduce the impact of a negative event or security breaches at any one brokerage.

For instance, if one broker experiences technical issues or goes bankrupt, your entire portfolio won’t be at risk.

Access to a Wider Range of Markets

Different brokers may offer access to different markets, asset classes, and risk management features.

Also, you can gain exposure to a wider range of encryption opportunities.

For instance, one broker might specialize in equities, while another provides access to commodities, forex, or cryptocurrencies.

Do You Know?:

It is seen that an average individual investor underperforms a market index by 1.5% per year. On the other hand, active traders underperform by 6.5% annually.

Diversifying your brokers allows you to take advantage of various capabilities and potentially capitalize on emerging trends.

Broker-Specific Benefits

Each trading broker may offer unique benefits, such as advanced trading tools, research resources, or lower trading fees.

With multiple brokers, you can take advantage of these specific benefits and tailor your trading strategy accordingly.

This can help you optimize your trading performance, achieve better results, and terminate potential errors to cyber threats.

Regulatory and Geographic Diversification

Different brokers may operate under various regulatory frameworks and can be located in different geographic regions.

Diversifying across brokers with distinct regulatory oversight can provide an added layer of security.

It ensures that your investments are subject to different regulatory authorities, reducing the risk of a single regulatory change affecting your entire portfolio.

Enhanced Liquidity and Execution Speed

Having accounts with multiple brokers can also enhance your liquidity and execution speed.

When you trade across various platforms, you can tap into multiple sources of liquidity, potentially reducing the impact of large trades on market prices.

Also, you can choose the broker that offers the fastest execution for a particular trade, improving your overall trading efficiency.

How to Diversify with Multiple Trading Brokers

Now that we’ve discussed the advantages of diversifying with multiple trading brokers for network security, let’s explore how to implement this strategy effectively:

Assess Your Investment Goals and Risk Tolerance

Consider your financial objectives, time horizon, and how much risk you are willing to take. Your diversification strategy should align with your overall investment plan.

Research and Select Reputable Brokers

Choose reputable brokers with a strong track record of reliability, security, and customer service.

Conduct thorough research to understand each broker’s offerings, fees, and features.

Look for brokers who have a good reputation in the sector and are subject to respected authorities’ regulations.

Remember, choose the one with a proven record security, reliability, and customer support.

Nonetheless, if you are using TradingView for your network security, technical analysis and charting needs, consider searching for a list of brokers that work with TradingView to find brokers that offer seamless integration with this popular trading platform.

This integration can provide you with a more streamlined and efficient trading experience, allowing you to make well-informed decisions at a time of utilizing the tools and features of TradingView.

Allocate Your Assets Strategically

Determine how you will allocate your assets across different brokers.

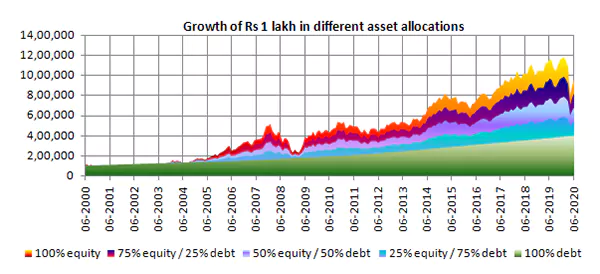

Statistics:

The chart mentioned above demonstrates the growth of Rs 1 lakh investment in different asset allocations in the last 20 years.

Make sure the allocation should be based on the investment goals, strengths of each broker, risk tolerance, and the specific strengths of each broker.

For example, if you want to trade cryptocurrencies, you may allocate a portion of your portfolio to a crypto-focused broker.

Monitor and Rebalance Your Portfolio

Regularly monitor your portfolio and assess the performance of each broker.

Rebalancing is mandatory to maintain your desired asset allocation, risk tolerance, and to make further adjustments based on ongoing market trends.

It is recommended to always keep an eye on any changes in the brokers’ offerings, fees, or services, and adjust your portfolio accordingly.

Stay Informed about Recent Cybersecurity Trends

Stay informed about regulatory changes that may impact your brokers or the markets in which you trade.

This can be achieved by knowing recent cybersecurity threats, vulnerabilities, and emerging risks.

Different regions may introduce new rules or restrictions that affect your portfolio.

Being attentive to those trends will help you make informed decisions and adapt your strategy as needed.

Here are a few examples of risks:

- Company-specific risk

- Single asset class risk

- Currency risk

- Geographical exposure risk

- Investment style bias

Maintain Security Measures

Ensure that you maintain strong security measures for all your trading accounts.

Use secure passwords, enable two-factor authentication, and regularly update your security settings.

Protecting your accounts is vital to avoid any unauthorized access, as the security of your investments depends on it.

Potential Challenges and Considerations

Well, diversifying offers numerous benefits, it’s paramount to be aware of potential challenges and considerations:

Increased Administrative Work

Managing multiple trading accounts can be more time-consuming and require additional administrative work.

Concerning this, you’ll need to keep track of multiple logins, account statements, and tax documents.

Besides this, you can also employ portfolio management software or tools to streamline the process.

Additional Costs

Using multiple brokers may involve additional costs, such as account maintenance fees, trading commissions, or currency conversion fees.

Be mindful of these costs and calculate them into your overall trading strategy.

Moreover, you can also try to negotiate and land on the same page consisting better rates with your brokers.

Psychological Impact

Managing multiple accounts can also have a psychological impact and complexities.

It may be challenging to stay focused and disciplined when juggling multiple trading strategies balances, transaction histories, and accounts.

Interesting Fact:

It is witnessed that in the first two years, 80% of all-day traders quit.

Ensure that you have a well-defined trading plan and stick to your strategy to avoid impulsive decisions.

Broker Integration

Some traders prefer the convenience of having all their assets with a single broker for ease of management.

If you choose to diversify, make sure that the brokers you select have compatible trading softwares and tools that suit your needs.

Integration with brokers ensures less hassle.

Conclusion

Diversifying your portfolio with multiple trading brokers can be a valuable strategy to enhance risk management and access a broader range of investment opportunities.

However, it’s necessary to approach this strategy with careful planning and consideration.

Assess your investment goals, research and select reputable brokers, allocate assets, monitor your portfolio, stay informed about security threats, and maintain security measures regularly to meet desired goals.

By doing so, you can reap the benefits of diversification when managing the potential challenges effectively.