When smart technology became normalized due to our phones, it was only a matter of time before homes and vehicles followed. There was a report of at least 15 million homeowners in 2016. By 2021, the number had increased to over 35 million.

These households are not products that are still finding their barrings. They are on the verge of breaking into the mainstream, and owners’ financial coverage providers could not be more thrilled. That’s why they tend to treat them to a break on their homeowners’ insurance rates. In this article, we’ll explain why these companies reward these homeowners.

Why Homeowners’ Insurance Incentivizes Smart Homes?

Smart homes do far more than just offer convenience through voice commands and automated functions; they can play a role in reducing your residence’s daily energy footprint and increasing protection. In this section, we’ll talk about several factors why insurance companies like this.

Financial coverage companies like this because they can lower the risk of the policyholder filing a claim for damages. Insurers often look at the safety features of a house such as smoke alarms, monitorable plumbing, and security systems to gauge risk -similar to how they look at cars and their drivers when underwriting auto policies.

They can monitor and automate several things at once, essentially keeping the house safe 24 hours a day. They often give a premium reduction for all the mentioned features. Sometimes, the home insurer may help cover the installation of a technical device in the place.

Do You Know? The number of smart homes in the global market is expected to be 478.2 billion by 2025.

Smart Home Devices that Can Cut Down Home Insurance Premiums

Being a smart homeowner, you can cut down a lot of costs on your residence’s insurance premium. In this section, we’ll talk about a few technologies that can help save money.

- Security Cameras – Security or CCTV at places are significant. They are easily available in the market with a variety of companies providing the services. These cameras can be installed at your front, back door, garage, or even in the living room.

They will track all the suspicious activities around your house and even help in preventing them.

- Water Leakage Detector – If you have a water sensor or leakage detector and there’s a leakage or a crack somewhere in a pipeline, the device will alert you and prevent the accident from happening.

In this case, no claim will be filed against the contractor, as the technology caught the problem early and prevented accidents and expensive claims as well.

- Fire Alarm or Smoke Detector – A fire alarm or smoke detector will alert the owner if there’s any fire or smoke via a mobile application. This prevention of such accidents is another way of cutting costs on premiums.

- Smart Thermostats – Many thermostats today not only control the temperature of the house but also warn about leakages or fires. This way they can help you in saving the cover premium.

Normalizing Smart Homes

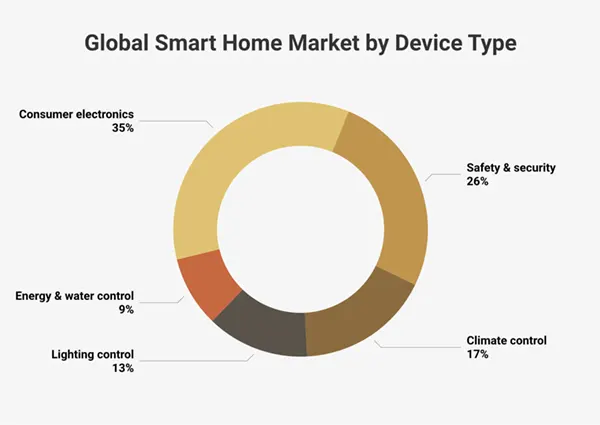

(This is a breakdown of the global smart home market share by device type).

Some companies that specialize in owners’ insurance are joining the effort to normalize smart houses by offering more than just coverage. Insurers may offer sensors or hardware of their own in addition to covering certain installations, as previously mentioned.

Major effort goes into risk or hazard detection systems, such as fire or flood detectors. Having these technologies not only lowers owners’ premiums but also helps settle claims faster with the data they may be recording. This information can be shared with the coverage provider as well, so they can gauge home needs more in-depth.

Smart Homes and Security Issues

While these smart electronics are here to protect us from theft, damage, or any accidents, they are creating the risk of reducing personal data safety as well. These data leak vulnerabilities often include hackers remotely controlling devices like TVs, lights, etc.

A 2021 research showed smart residences are typically exposed to info attacks. The two most common flaws in these systems are vulnerable local networks and weak IoT services. Thus, it is also imperative to take necessary protective actions.

Conclusion

Insurers will continue to support the use of innovative technology designed to identify damage and prevent losses as fewer individuals file claims and the industry changes.

For customers, analyzing the benefits offered by different home monetary cover providers may not only entail comparing rates but also deciding whether a certain smart technology perk is worth it.