Rapid innovation drives business. Latest technologies, cutting-edge machinery, and inventive software are the game changers, often differentiating leaders from followers in field landscapes.

Budding trades, with their inherent agility and adaptability, are ideally poised to leverage these advancements.

However, one major obstacle often stands in their way: a lack of sufficient capital for purchasing or upgrading to new tools. This is where small business equipment credit comes in, providing vital support for industry innovation.

Let’s explore how.

Breathing Life into Ideas

In the absence of substantial backing or hefty profits, small traders can face significant financial constraints when trying to upgrade or replace their material.

Without technology or machinery, they can quickly fall behind, unable to compete with better-equipped competitors or capitalize on creative ideas that could disrupt their industry.

Micro-business equipment mortgages bridge this gap, offering financial assistance designed specifically for purchasing or leasing new tools.

This could include cutting-edge machinery for a manufacturing company, software for a tech startup, or medical accessories.

By breaking down economic barriers, these loans enable budding traders to transform their innovative ideas into tangible, market-changing products or services.

Fueling Productivity and Efficiency

The potential of small businesses isn’t limited to disruptive ideas. The daily grind of operations also holds considerable room for creativity. Technology can boost productivity, simplify processes, and lower costs.

Do You Know?: According to the Federal Reserve Banks’ Small Business Credit Survey, 59% of small businesses reported being in fair or poor financial condition.

Loans for business equipment allow these companies to implement such advances. They may maximize production or service value with more efficient gear or software.

Setting new standards and compelling rivals to conform boosts industry innovation and competitiveness.

Nurturing Growth and Expansion

These loans don’t just fund the present—they also facilitate future growth. With upgraded tools, small dealers can expand their capacities, explore new markets, and offer novel solutions.

They can further leverage their lean structures and agile processes to experiment with different applications of their equipment, spurring industry invention in surprising and significant ways.

Let’s take an example. A small bakery, backed by an equipment mortgage, could purchase the latest oven that can bake in larger quantities and with greater precision.

Do You Know?: According to the Federal Reserve’s Small Business Lending Survey, in Q1 2022, the small business loan balances to decreased 7.6% from the prior quarter and 35.9% from Q1 2021.

This bakery might then introduce a range of innovative, gourmet products that weren’t possible with their old oven.

Not only does this open up new revenue streams for the bakery, but it could also potentially disrupt the local bakery market and inspire similar creations.

The Top 5 Types of Equipment Funded by Small Business Loans

While the potential applications of new business equipment allowances are boundless, certain types of apparatus are particularly popular among loan recipients. Here are the top five:

- Technology Equipment: From advanced computer systems to innovative software solutions, technology is a common focus, particularly given its capacity to revolutionize micro merchants across industries.

- Heavy Machinery: Manufacturing and construction businesses often require expensive machinery, and these credits are instrumental in making these purchases possible.

- Medical Equipment: For small healthcare providers, staying current with the latest medical technologies can be a matter of survival. These loans make these critical upgrades feasible.

- Restaurant Equipment: Upgraded ovens, refrigeration units, or even espresso machines can enable restaurants and cafes to expand their offerings and enhance their services.

- Vehicles: For businesses in fields like logistics, agriculture, or trades, vehicles form an integral part of their operations, and equipment loans can be crucial for maintaining or expanding fleets.

Types of Equipment Financing

These credits help businesses to purchase equipment required for operations. But, did you know there are several types of tools financing you can opt for?

- Term Loans – In this type, you can borrow a lump sum and repay it over five to ten years. This loan can be suitable for several needs.

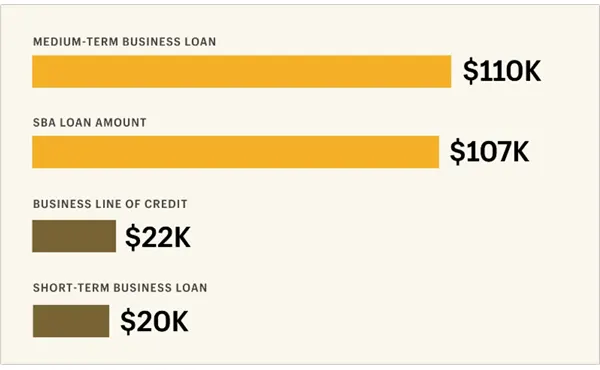

Here’s a breakdown of the different types of business loans and their average lending amounts:

The average amount of short-term business loans is $20,000.The average amount of medium-term business loans is $110,000.The average amount of SBA loans is $107,000.The average amount of business line of credit loans is $22,000.

Though these mortgages are unsecured and based on your business only. They are comparatively hard to get and have high interest rates.

- SBA Loans – The Small Business Administration provides four types of loans – 7(a), 504, Express, and Microloans.

- 7(a) Loans – are the most common type used for equipment purchasing and other expenses.

- 504 Loans – The maximum credit limit of this allowance is $5.5 million, and they are generally used to buy large pieces of machinery.

- Express Loans – They are the same as 7(a) and can be approved within 36 hours but provide only up to $3,50,000.

- Microloans – This type of credit is the easiest to get. They provide up to $50,000 and are generally utilized by new businesses and underserved communities.

- Equipment Loans – This is the standard option for financing machinery. Generally provided by banks and other lenders, sellers can also help you in getting these financial aids.

Small company loans help businesses innovate, compete, and grow by purchasing machinery. They help micro firms, often the underdogs in their sectors, remain current and complete.

Thus, company equipment allowance boosts industry-wide development and innovation.