The world of banking is not the same as it was a decade ago. The most reliable and stable term deposits are also changing with time as they adapt to the digital age.

You can easily find out how you can get the best term deposit rates by Great Southern Bank or any other bank by simply Googling it.

In this blog post, we will discuss the future of term deposits in this tech-driven world and how they are evolving to remain an attractive investment option in the digital era.

The Appeal of Term Deposits

Term deposits have been the go-to investment for many people for decades because of their secure and stable returns, even in a volatile or declining market.

Here are a couple of reasons why term deposits have been so popular over the decades:

- The Basics: It is basically a kind of financial agreement between an individual and the bank to invest money for a fixed period of time. And in return, the bank guarantees that they will provide a higher interest rate than the savings account for the investment period.

- Guaranteed Returns: The one thing that makes fixed-term deposits most attractive is the guaranteed returns, irrespective of market volatility.

Subtitle: Where to find a term deposit facility.

The Evolution of Term Deposits

Term deposits have changed in a number of ways in order to remain relevant and competitive in the digital age. The goal of these modifications is to give depositors a more practical and easy-to-use experience.

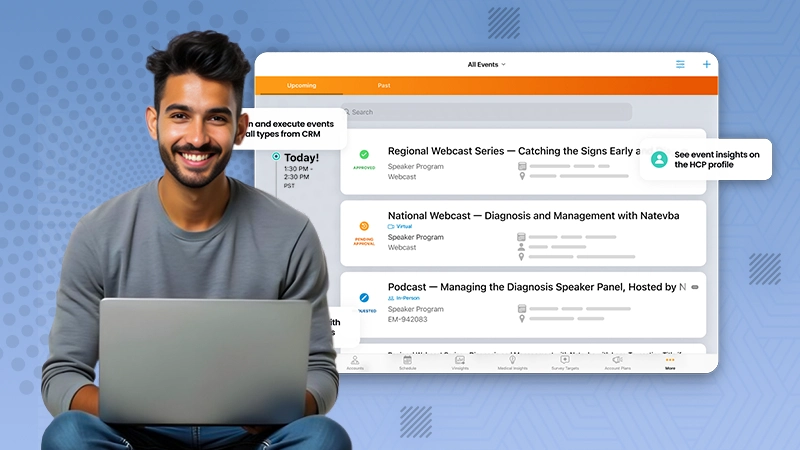

Online Account Opening and Management

One of the most noticeable changes in the world of term deposits is the ability you get to open and manage your accounts online.

You will not need to go to the bank anymore because the bank will come to you.

Here are the reasons why online accounts are a benefit for you:

- Simple and easy UI: Because of the easy-to-navigate and simplistic UI of the banking apps and mobile sites, you can easily manage all your account-related tasks from one place.

- Real-Time Account Management: With the ability to manage your accounts in real-time, you get more transparency and better control over your financial assets. Plus, you get the added benefit of getting notified about your term deposit status and transaction history.

Blockchain and Crypto

Now, it’s not just the internet and online facilities that have brought a change in how you experience term deposits. Blockchain and crypto have taken a piece of the cake too.

As is with any new technology, with popularity and change comes adaptability.

Blockchain is known for its transparency and security. This can be integrated with term deposits to ensure secure and tamper-proof alternatives for investment.

In terms of blockchain and crypto-backed fixed-term deposits, customers can also earn interest on their crypto investments.

This just shows us how flexible fixed-term deposits can be in terms of adapting to new technology and innovations.

DID YOU KNOW?

An investor who does not require their money at the maturity of the term deposit has the option to roll over the deposit for a fresh term.

The Future of Term Deposits

Looking back on it, the future of term deposits looks pretty promising. With continued innovation and digital adaptation, we can only ponder what the future will look like.

Our Predictions

Term deposits are more than likely to become more dynamic, with flexible terms and conditions that can cater to the customer’s many needs and demands.

Many financial institutions might also combine the benefits of term deposits with other products or investment options.

Better Accessibility

With online and mobile banking becoming the norm, we can expect the experience to be further improved to cater to a larger audience with more easy-to-use navigation options and a better UI.

Even with technological innovation, fixed-term deposits will continue to be the people’s choice for stable and reliable returns. Getting the right kind of balance between them may be a key to its future success.

Need for Better Security in an Online Era

While the internet can bring about convenience, it also breeds concerns about security. Because of this, many financial institutions are constantly working to address these concerns.

Conclusion

Term deposits have proven to us that they are able to adapt to the changes in the present era.

The integration of technology has made them more accessible and secure.

While the financial sector undergoes many changes, term deposits continue to provide investors with peace of mind and financial security.

Frequently Asked Questions

Ans: It is a kind of investment where you invest your money in a bank or a financial institution for a fixed period of time at an agreed-upon interest rate, which is usually higher than the savings account.

Ans: Term deposits are used for short-term investment periods like three months or six months. Fixed deposits are used for longer periods, like six months or more.

Ans: On a term deposit, your money is locked away for a fixed period of time in order to earn interest. If you need your money before the term ends, you may have to pay a penalty fee.

Ans: You multiply the deposit amount, such as $10,000, by the interest percentage, such as 2% or 0.02, to find the annual interest earned. To find the total interest earned, multiply that amount by the number of years.

Ans: You have the option of receiving interest payments on a monthly, quarterly, half-yearly, annual, or at-maturity basis, depending on the term you choose.

Ans: It describes the process of reinvesting maturity proceeds into a new term deposit, increasing the interest rate. So, an investor does not have to use their money as soon as the term deposit matures.