In today’s ever-changing economic landscape, many individuals seek opportunities to supplement their income through side ventures. Exploring alternative revenue streams has become a popular way to achieve financial investment to boost their income goals and enhance financial security.

In this article, we will delve into three activities that have proven to be effective in generating side income, offering valuable insights and inspiration for those looking to diversify their earnings and unlock their full earning potential. Here are 3 ways of this:

Freelancing and Gig Economy Opportunities

The emergence of the gig economy has unlocked a wide array of freelancing possibilities in diverse sectors. These opportunities span from creative fields like writing, graphic design, web development, online trading, or practical assistance roles such as virtual support. Freelancing platforms present a versatile avenue for individuals to leverage their unique skills and knowledge.

The gig economy also allows you to take on multiple projects simultaneously, giving you the freedom to work on your own terms and potentially earn a substantial side income. Additionally many try their luck in online financial trading, especially on the FX market, where detailed guides, including arbitrage in FX trading, risks, and tactics are simply available to learn.

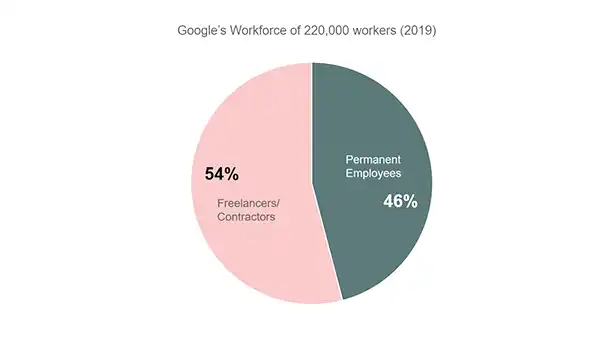

Fact: With the growing trend in the freelancing industry, it is reported that Google has 54% of its employees as freelancers or working on a contract, compared to 46% of permanent employees.

Renting Out Properties or Space

If you own an extra property or have unused space in your current residence, consider leveraging it to generate passive income. Renting out a spare room or your entire property through platforms like Airbnb can be a lucrative endeavor, especially in popular tourist destinations.

And, if you have a parking space or garage in a busy urban area, you can rent it out to commuters looking for convenient parking options. Maximizing the potential of your property or space allows you to generate a consistent income with minimal continuous input.

Online Course Creation and E-learning

In this era of digital advancement, the exchange of knowledge has turned into a profitable avenue for individuals possessing expertise in particular domains. If you possess valuable skills or knowledge, exploring the option of creating and selling online courses can prove highly beneficial.

E-learning platforms provide a convenient and accessible means to develop, promote, and reach a worldwide audience with your educational offerings. Whether it’s a language course, photography tutorials, or business coaching, people are willing to pay for high-quality educational content. Once you have developed your course material, it can become a passive source of income, with minimal maintenance required as the platform handles enrollment and delivery.

In conclusion, these three activities—freelancing in the gig economy, renting out properties or space, and creating online courses—present excellent opportunities to boost your side income. By tapping into your skills, assets, and expertise, you can unlock additional earning potential and improve your financial outlook.

Remember that consistency, dedication, and a focus on providing value to your clients or students are vital for sustainable success in these endeavors. Whether you’re looking to supplement your current income or explore a new passion, these activities offer a path to financial growth and fulfillment.

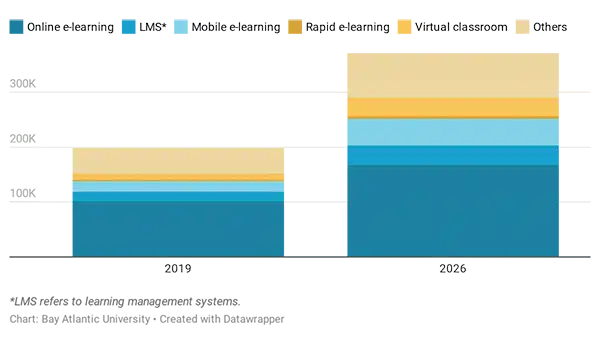

Fact: This graph shows the exponential growth in the number of students learning with the help of the Internet rather than physically attending schools.

Common Mistakes While You Try to Boost Income

Venturing into side income opportunities holds great allure, but it comes with its fair share of challenges. Many individuals encounter common pitfalls that hinder their progress and obstruct them from attaining desired financial outcomes. Unrealistic expectations top the list, as some hope for quick riches without realizing the dedication and effort required to see substantial returns.

With regards to the above, spreading oneself too thin by attempting multiple side income activities at once leads to a lack of focus and lackluster results. To make side income endeavors successful, it’s crucial to identify activities that align with one’s skills and passions, devoting ample time and effort to nurture them.

Neglecting research and planning is another grave mistake. Understanding market demands, competition, and potential challenges is imperative in crafting a successful strategy. Failing to conduct thorough research can lead to missed opportunities and unexpected obstacles. Moreover, underestimating the time commitments involved is a common error. Side income pursuits often demand additional hours beyond regular work, and overcommitment can result in burnout, affecting both the side venture and primary income source.

Ignoring marketing and promotion is detrimental to success. In the competitive landscape of today, outstanding products or services alone are not enough to garner attention and attract customers. To achieve visibility and success, it is profound to implement effective marketing strategies.

Crafting a strong marketing plan that amalgamates various channels such as social media and online platforms can be the key differentiator for your business. As well as prioritizing customer satisfaction is vital for sustainability. Repeat business and referrals are critical to sustaining side income, and failing to address customer feedback can hamper growth.

Lastly, mismanaging finances by blending personal and side income funds creates confusion and difficulty in tracking earnings and expenses. Maintaining separate accounts for side income activities ensures financial organization and clarity.

In conclusion, circumventing these common mistakes is essential to successfully boosting side income. Via adopting realistic expectations, focusing on select activities, conducting thorough research, dedicating ample time, implementing effective marketing strategies, and managing finances prudently, individuals can enhance their prospects for prosperous and sustainable side income growth.