The days when a simple bank statement could cover all your financial activity are pretty much a thing of the past.

The client profiles of today are much more complex and unique than they used to be, covering anything from transactional data (like personal information, online search behavior, shopping preferences, etc.) to customer location and other kinds of data.

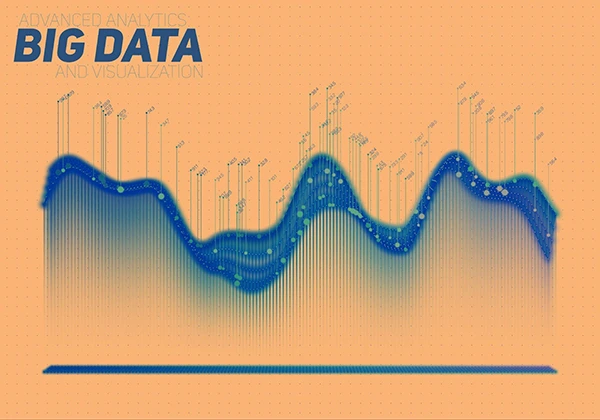

Big data analytics is like a game changer for the already fast-developing fintech industry.

It has pretty much changed the way that companies run their operations and improved their workflows.

You know, big data has also helped many businesses adopt new and more efficient techniques for fraud detection in fintech.

But how is big data protecting the fintech sector?

You know, risk assessment and anti-fraud tools are the areas that many fintech companies focus on.

Businesses are now using cutting-edge analysis to spot any abnormalities, find patterns, and reduce risks by using large amounts of data to their advantage.

DID YOU KNOW?

More than 64% of online businesses have been victims of some kind of financial fraud in the last 12 months.

In this article, we will discuss some of the new-gen approaches that reduce the fraud risk for fintech companies.

They involve some revolutionary approaches as well as methodologies already applied by some companies.

The Rising Tide of Fraud in the Digital Era

It’s 2024 and the whole world is moving towards a more digital space.

Many companies are moving their business model to online operations too.

But the world of the internet is far from a peaceful place that many would imagine.

There is danger lurking around every corner.

From viruses and malware to hackers and fraudsters, there are just so many things online that would do you more harm than good.

As the number of transactions online increases, there is a chance that fraudsters will try to take advantage of the loopholes.

So, the industry is now looking for more proactive and refined strategies for risk assessment.

General Risk Management Approaches to Fintech Fraud Prevention

You know, on the internet, every tap, click, scroll, or swipe leaves a trace of you behind.

Yes, even if you’re browsing incognito.

On average, internet users from around the world create over 328 million terabytes of data daily

Big Data helps companies compile these huge data pieces and parameters to create a digital profile with specific risk values.

Speaking in simpler terms, the technology helps organizations evaluate potentially risky clients or operations, perform data segmentation, and more.

And here is how.

Big Data for Risk Assessment

The usual way of risk assessment generally relies on small data sets and subjective judgments.

Thanks to the help of big data, fintech companies can now easily get access to financial data from many different sources.

These sources can include:

- social media

- transactional data

- consumer behavior

- market trends

- device-assisted and technical parameters

By using this data, fintech companies are now able to create complex risk models that can offer quicker and more accurate evaluations of creditworthiness, market risk, and investment opportunities.

This helps financial institutions and lenders make well-informed decisions, reduce risks, and provide customers with custom-tailored products and services.

Enhanced Fraud Detection Instruments

The banking system is subject to the biggest fraud risk.

And big data can help them greatly improve their fraud detection systems.

The real-time anomaly detection and suspicious activity flagging rely on machine learning algorithms.

They analyze large amounts of transactional data, user behavior, and historical trends.

As time passes, the accuracy of the fraud detection algorithm gets better and better.

This is thanks to the machine learning technology’s adaptability and learning efficiency.

Regulation and Compliance Standards

As we all know, big data analytics can help us process a huge mountain of data.

This data can also be used to find trends that can point to some regulatory issues, this can help the businesses to stay compliant.

Fintech organizations can also reduce the risks of non-compliance penalties, guarantee regulatory conformance, and uphold a transparent and safe financial ecosystem by automating compliance operations with advanced analytics.

Advanced Fraud Prevention Techniques Adopted by the Fintech Industry

While the points mentioned above only describe the general risk assessment methodologies that can be implemented with the help of big data analytics.

Some companies are already using the next-gen anti-fraud toolkits.

It helps market participants develop, expand, and offer safe and effective financial services. Here are some of these approaches:

Swift Detection Based on Real-Time Analytics

You know, one of the real benefits of using big data for fraud detection is the real-time analytics feature.

Retrospective analysis is a common component of traditional approaches, although it might not be timely enough to stop skilled fraudsters.

On the other side, big data analytics makes it possible to instantly analyze user behavior, transactions, and patterns, giving businesses the ability to spot possible fraud and take action promptly.

Anomaly Detection and Behavioral Analysis

Businesses can easily point out any anomalies that are different from the standard user behavior.

This means that it can be a sign of some suspicious activity or fraud.

In the age of online banking, e-commerce, and other digital activities.

This method works especially well because of its ability to quickly identify abnormal or complex fraudulent patterns in real-time.

ML-Based Methods and Predictive Analysis

The use of machine learning technologies in big data analysis can take fintech’s fraud detection capabilities to the next level.

It boosts traditional approaches by letting companies analyze historical data as well as spot patterns and trends linked to fraudulent activity.

Machine learning models are great at predicting and preventing fraud before it can even happen.

The system works as an active defense mechanism, which is part of the predictive fraud prevention methodology.

Identity Theft Prevention

By analyzing large datasets, like user data, transaction history, and access logs, big data can also help prevent identity theft.

Companies now have access to advanced analytics used to identify trends and irregularities associated with this particular type of fraud.

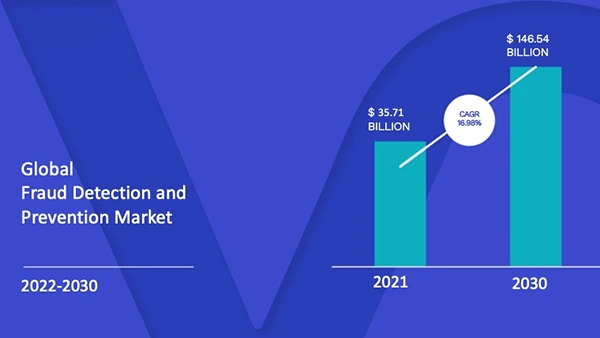

Fraud Detection and Prevention Market size was valued at USD 35.71 Billion in 2021 and is projected to reach USD 146.54 Billion by 2030, growing at a CAGR of 16.98% from 2022 to 2030.

In The Bottom Line

Big data analytics helps fintech organizations successfully identify, stop, and minimize fraudulent activity.

Businesses may preserve their financial resources and boost customer loyalty by implementing a thorough fraud management strategy.

At the same time, fraudsters evolve with the industry.

They change and elevate scamming approaches.

This is why it is necessary for companies to constantly improve their fraud detection techniques.

It will let them stay ahead of the curve and guarantee strong safety and financial integrity.