Bitcoin comes with the underlying technology known as Blockchain. It helps add to the blockchain infrastructure that remains a significant innovation. It has been predicted by various research groups as a relevant financial medium that will stay in the society even with alternatives.

Thanks to the people like S Nakamoto, Bitcoin emerged like a magic touch in the crypto world. It helped shape the imaginations of people embarking on a currency working in an unorganized fashion.

Since it was invented, we can see variety of cryptocurrencies in the market working seamlessly. We can find several comparisons taking place in the original hype of the virtual currency world.

The coin was the first crypto in the market that started working with the help of Blockchain technology, which made it possible for multiple currencies to enter a niche area.

We can call Blockchain technology an innovation that has come along with Bitcoin itself. It has remained a major factor for adopting crypto in the community.

In this article, you will learn about the six features of cryptocurrency that makes it the best trading option.

Why is BTC More Valuable Than Other Cryptocurrencies?

Bitcoin is among the most expensive crypto coins in market capital and price. There are a variety of reasons for the same, and a few of these are indicated below:

Biggest User Base

As per reports, there are more than 10 million BTC wallets on the web across the globe. Hence, many people have invested in this domain, and others are eager to use it.

One of the challenging reasons is that its expensive compared with other coins in the massive digital currency market. It is always easy to gain the investment with a secured transaction.

The currency’s value is maintained and developed using powerful digitization that allow people to secure their transactions. All these factors help in soaring the coin’s value in a big way.

A vast user base adds credibility to attract investors and thus allowing more participants. As many people are lured to this technology, the demand for the BTC has gone up. It has helped in gaining a quick price to act similarly.

DO YOU KNOW? The economist Milton Friedman predicted the concept of a decentralized digital currency similar to Bitcoin in 1999.

A Growing Number of Merchants Accept BTC.

The number of merchants accepting BTC is growing at a faster pace. These include the food giants like Mcdonald’s and Amazon, which are now receiving payment using Bitcoin.

You can also find it to be most valuable, and it keeps on rising in the market with vendors looking for worldwide consideration in the integration. It has adopted widely that helps increase the demand in a big way.

The likelihood of a decline in the value of BTC is quite low due its finite amount of availability. As businesses in different sectors adopt to bitcoin, there is also chances of government regulations to streamline its functionality which will also make it secure from hackers.

Other cryptocurrencies are issued on the basis of people who are seeking indirect means of minting money. Whereas, Bitcoin still stands as a leader because it is based on a predetermined that is transparent for anyone to see.

It is the First in the Market.

As we see, Bitcoin is now becoming the first digital money that introduced the idea of crypto. Still, the infrastructure can help in allowing varied other benefits. All these things have established digital transactions in a big way.

BTC helps gain an excellent option for banking with the curious minds now wanting to join this movement. Thus we see a majority of people are now transacting with Bitcoin, and they maintain an excellent mainstream media attention.

Also, multiple users are adding value to the BTC, and we help in managing the Blockchain recognizing the things for users who contribute significantly to the Bitcoin.

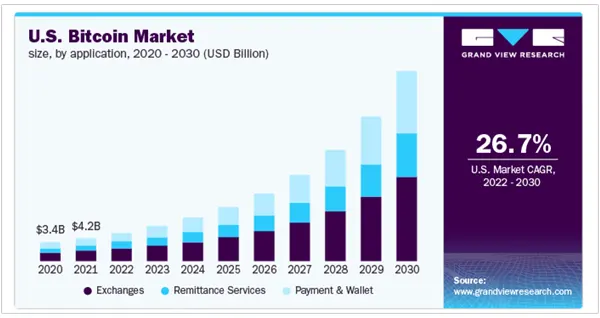

The graph below is a clear indication of the exponential rise of the Bitcoin which is predicted to continue till 2030 and beyond. The reasons is easier and faster payment alternatives, overall market adoption, and robust security.

Most Viable Infrastructure

Bitcoin is credited with inventing the idea of Blockchain or any distributed ledger. Varied platforms, including LTC and ETH, are developed on similar respective infrastructure for virtual transactions. But most of these coins follow BTC framework as it is robust and seamless to utilize.

For example, ETH or Ethereum secure used a code that can be changed to pretend a hack never happened then it can also be reversed to prevent certain transactions going through. Since BTC is decentralized, there is more freedom to utilize money without intervention or censorship.

It is decentralized system can withstand attacks from regulatory forces that tend to limit the freedom of transactions by manipulating market growth for the present and the future. Bitcoin’s power is distributed across the globe through users who can run full modules.

It is extremely secure and ultimate with varied features to trasact. The main drawback is that they are associated with Bitcoin, The financial crisis is created by technology that makes promises it cannot keep.

Bitcoin users can also opt to make their transaction easy or difficult to confiscate. It is simple to audit with a command compared to other cryptos in the market. In fact, the digital currency has a supply of 21 million bitcoin and no one can change this limit.

As AI and automation is spreading its web in all industries making it easier for ventures to become productive, so does the financial world is looking forward utilizing BTC for their business. In this way, Bitcoin is more valuable than any other coin as it can make a huge difference to the crypto ecosystem.