So, you’ve caught the Bitcoin bug, huh? Welcome to the club!

You’re about to join a global community that’s not just investing in a cryptocurrency but in a vision of decentralized financial freedom. But let’s not get ahead of ourselves.

First things first: you need to know how to buy Bitcoin for Bitcoin trading, and you need to know how to do it right. This isn’t just another purchase; it’s an initiation into a new world.

Ready to take the plunge? Let’s get you started on your BTC journey with this easy-to-understand guide.

Buckle up!

Choose a Platform: Your Gateway to the Bitcoin Universe

The first step on your Bitcoin journey is selecting the right trading platform, and each type comes with its own set of features and benefits:

Cryptocurrency Exchanges

These mediums are the go-to places for buying BTC online. They offer a wide range of cryptocurrencies and are designed to be user-friendly, making them a popular choice for both beginners and seasoned investors.

Brokerage Platforms

These are financial platforms that provide a variety of assets, including stocks, bonds, and, yes, Bitcoin. They’re a good fit for those who want to manage all their investments in one place.

Peer-to-Peer (P2P) Platforms

For those who like to keep it personal, P2P platforms offer direct transactions between consumers and sellers. They provide a more customized experience and often allow for a wider range of payment options.

Bitcoin ATMs

If you’re someone who values the experience of a physical transaction, Bitcoin ATMs provide a quick and straightforward way to buy them.

Bitcoin Curiosity: According to Statista, there are Bitcoin ATMs in 84 countries worldwide and the champion country is the United States of America with more than 30,000 automatic machines.

Payment Methods: Can I Buy Bitcoin with a Credit Card or Debit Card?

One of the most frequently asked questions by newcomers is, “Can I purchase Bitcoin with a credit card?” The short answer is yes, you can add bitcoins in different ways but the availability of this option can vary depending on the platform you choose.

Here, we’ll explore the different payment methods you can use to buy BTC:

Credit Card

Many mediums do allow credit card purchases, but be aware that these often come with higher fees.

Debit Card

This is another convenient option offered by most platforms to purchase bitcoin with a debit card. It’s similar to a credit card but usually incurs lower fees.

Bank Transfer

For those who prefer to go the traditional route, bank transfers are widely accepted but can take longer to process.

Take Note: You can add your debit card to the App Store, Google Pay, or AppGallery, depending on your smartphone OS, and enjoy the convenience of investing in Bitcoin with fiat currency. Many exchanges and crypto wallets provide these integrations. Do your research and choose wisely.

Do You Know?:-

As of December 2020, around $15 billion worth of crypto had been lost to exploits, scams, and hacks. By October 2023, this increased significantly to over $77 billion.

How to Buy Bitcoin with Cash: A Guide for the Old-School Investor

In a digital age, the idea of purchasing BTC with cold, hard cash might seem a bit out of place. But for those who prefer the tangibility and immediacy of paper money, there are ways to invest in it without ever touching a screen.

Here’s how to buy Bitcoin with Cash:

P2P Platforms

Websites that offer peer-to-peer transactions often allow cash payments. You can arrange to meet the seller in person and exchange cash for BTC, which will then be transferred to your online wallet.

Bitcoin ATMs

Believe it or not, it is an advantage of Bitcoin that there are ATMs specifically designed for their transactions. Just like a regular ATM, you insert your cash and receive it in return. The transaction is immediate and secure, but fees can be higher than online methods.

Local Events

Some cities host BTC or general cryptocurrency meetups, where you can exchange cash for digital currencies in a safe and social setting.

Create and Secure Your Account: Your Digital Fortress

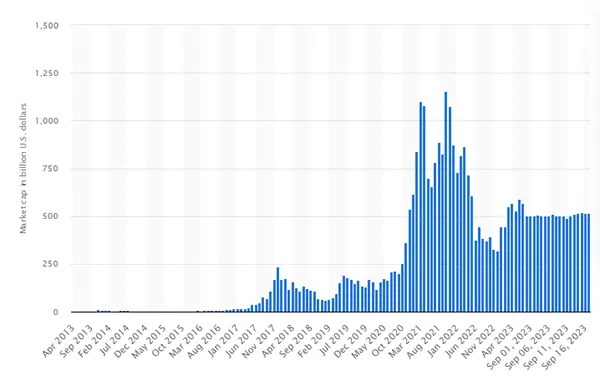

(This graph shows the market capitalization of Bitcoin from April 2013 to September 2023, in a Billion U.S. dollars).

Once you’ve chosen your medium, the next step is setting up your account. This is more than just a formality; it’s the creation of your digital fortress where your amount will reside.

Creating an Account

Creating an account usually involves providing an email address, creating a strong password, and sometimes, going through a verification process. This might require additional personal information or documents to comply with regulatory requirements. Think of this as laying the foundation stones of your fortress.

Securing Your Account

Now that your account is set up, you’ll want to make sure it’s as secure as possible.

Here’s how to secure your Bitcoins:

Two-factor Authentication (2FA)

Enable 2FA as an extra layer of security. This usually involves linking your account to a mobile device and receiving a unique code during the login process. It’s like having a secret handshake to enter your online fortress.

Cold Storage

For added security, especially if you’re planning to hold a significant amount of Bitcoin, consider using cold storage options like a hardware wallet. This is akin to having a treasure chest within your fortress, hidden behind another set of locked doors.

By taking the time to properly secure your account, you’re not only protecting your investment; you’re gaining peace of mind. And in the volatile world of cryptocurrency, that’s worth its weight in BTC.

Conclusion: Your Journey Has Just Begun

Congratulations, you’re now equipped with the knowledge you need to purchase Bitcoin, no matter if it’s online, with a credit card, through a debit card, or even with good old-fashioned cash.

You’ve learned how to choose the right trading platform that suits your needs, how to create and secure your digital fortress, and the various payment methods available to you.

But remember, buying BTC is just the first step in a much larger journey. The world of cryptocurrency is vast, exciting, and constantly evolving. Whether you decide to “HODL,” trade, or dive into the deeper aspects of blockchain technology and decentralized finance, the options are nearly limitless.