We all know that the earlier you learn about the basics of how money works, the more confident and successful you’ll be with your finances later.

The finance industry can be a pretty unpredictable and chaotic place.

You need to learn to comprehend new and changing market patterns. Besides, it is never too late to start learning about the financial world.

In 2024, banking, budgeting, savings, credit, debt, and investing will be the core parts of most of our financial decisions.

So, let’s get into the world of financial literacy and learn more about what it is and how it can improve your life.

But, if you want to know more about financial literacy, then sign up here.

So, What is Financial Literacy Exactly?

An individual basically can understand and make use of their financial skills in a good way.

These skills include things like personal financial management, budgeting, and investing.

Aside from this, you also need to understand concepts like the value of time and money, compound interest, debt management, and financial planning.

Being financially literate is one of the core skills that one needs to fit in with today’s society, and it also stops one from making any poor financial decisions.

Financial literacy is also the key to making sure that people, no matter what their income or social status, can not only have access to some basic financial services but also know how to use them.

Why is Financial Literacy so Important?

Well, it’s mostly because financial literacy allows you to make more informed and responsible decisions relating to your finances.

Plus, it also helps you understand things like budgeting, saving money, investing, debt management, etc.

You can pretty much also protect your future self from any financial emergencies and build up wealth to keep up with your goals.

Benefits of Financial Education

It provides an extensive and complete understanding of financial principles, risk management, and investment strategies, as well as inclusive knowledge of banking operations.

These skills are vital to understanding and achieving financial stability.

Getting educated in the field of finance offers some real-life benefits.

It does not just open future career options but also helps improve the quality of life of an individual by helping them achieve financial stability.

Enhanced Career Opportunities

It helps open doors to a variety of career opportunities in the finance industry.

Potential employers may place more value on candidates with more specialized knowledge and skills.

Thus, this makes people with skills in the field of finance, such as financial analysis, investment banking, and financial planning, more sought after.

In-depth Knowledge and Expertise

Through rigorous hard work, experience, and attending networking events hosted by institutions, people can develop critical analytical skills, financial modeling abilities, and an exhaustive understanding of financial markets.

This knowledge allows them to make informed decisions and contribute more effectively in their chosen career roles.

Increase in Demand Within The Growing Sector

Finance industries across the globe offer a wide range of career opportunities.

Pursuing financial education may lead to the opening up of various career paths for individuals, like financial analysts, investment banking, risk management, and many more.

The 5 Basic Principles of Financial Literacy

These principles can act as a GPS for good money management and are the basis of a strong financial foundation.

If you can learn more about them and put them into practice, you can easily improve their financial situation in the present and in the future too.

There are basically five principles of financial literacy:

Earning Money

The money you get through your income is the basis of all your personal finances. It is also the basis of your lifestyle and financial future.

Saving and Investing

You need to create a good budget. This can also help you put aside some extra money for your savings and investments.

By doing this, you can make sure that your wealth grows and you might even be able to buy that house you keep dreaming about soon.

Borrowing and Managing Your Debt

This is a way that allows you to make some pretty big purchases while still being able to build your credit.

You can use your loans to pay for your new car, your sister’s iPhone, or even pay off your college fees.

But you need to keep in mind that, just like having too much of anything is bad.

So if you have a large enough debt, it can put your financial future in pretty dire straits.

Spending and Planning

So the next time you get your paycheck, you need to think about putting it into the 50-30-20 budget or the 80-20 strategy.

If you’re following the 50-30-20 budget, this means putting 50% of your paycheck toward needs, 30% toward wants, and the remaining 20% toward savings and investments.

This is one of the many personal finance strategies that can help you keep your spending on track.

And, with the 80-20 budget, you “pay yourself first” by setting aside 20% for savings, then using the remaining 80% for both fixed and other expenses.

Protecting Your Assets

You also need to have a way of protecting all your money.

So, think about keeping some money aside for emergencies, just in case.

Plus, make sure that it is enough to cover at least six months of your monthly expenses in case you lose your job.

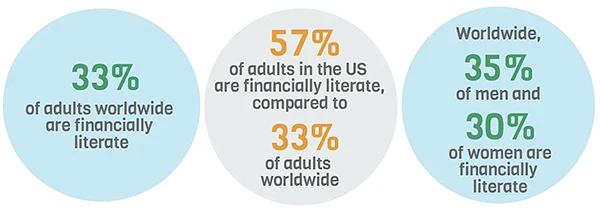

DID YOU KNOW?

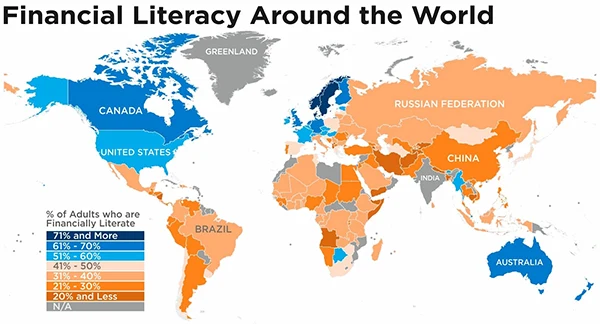

Only 33% of adults worldwide are financially literate, leaving billions unable to manage their finances.

Top 5 Trends in the Finance Industry

The future of finance is jam-packed with opportunities.

If you’re ambitious enough to want to create a career in this area, you must become aware of the most important trends within this area.

Private Companies Will Look For New Ways to Invest

In recent years, the financial sector has seen many hurdles. Given the enormous ups and downs in this business, private firms are looking for new investment opportunities.

It is nonetheless important to recognize the significance of making innovative investment decisions.

Innovative investment channels in private markets under the Doctor of Business Administration program can help introduce businesses with multiple funding opportunities and possibilities while also attracting a varying group of investors.

AI and Machine Learning Will Shape the Future of Finance

In the future, AI and machine learning will play pivotal roles in the banking industry.

They will make it possible for us to get more precise and accurate data faster, as well as provide us with better risk management and the development of innovative financial products and services.

AI and machine learning allow financial organizations to make more informed decisions and improve operational efficiency.

Still, we should apply AI and machine learning in the banking business in a more ethical manner to comply with government policies and provide sufficient risk management to its customers.

ESG Investing

ESG, or Environmental, Social, and Governance Investing, will play a very major role in shaping the future of finance.

ESG considerations will have a huge impact on a company’s financial performance and viability in the long term.

Investors are becoming very conscious in terms of the impact their investments will have environmentally and socially.

ESG factors, as a result, can have a substantial impact on investment decisions and avoid risks, which can give rise to long-term gains.

Open Banking

Through open banking systems, customers can securely exchange their financial information with authorized and approved third parties.

Customers can have access to many varieties of alternative banking facilities, money management apps, etc.

Open banking can also enable real-time account collection, which results in lower prices and more convenient conditions for its customers.

Cyber Security

Cybersecurity is yet another major defining feature in the future of banking.

It can protect and stop unauthorized parties from accessing private financial information.

Cyberattacks are becoming very common, which may result in severe damage to client trust as well as financial loss.

Hardcore cybersecurity measures can protect against cyber attacks and prevent financial loss. Firewalls and multi-factor authentication are some ways financial institutions use cybersecurity to prevent financial loss.

DID YOU KNOW?

Financial literacy boosts financial market participation, curbs informal borrowing, and improves financial resilience.

Conclusion

By getting a good financial education, individuals can equip themselves with the necessary knowledge and skills to excel in the finance industry.

They can prospect for very well-paid career opportunities, contribute to the growth of the economy, and secure their financial future.