With every innovation that is taking place, the world is rising higher in the skies of technology. From education and office work to research and management, everything has gone digital in current times. With the addition of blockchain technology, the case is no different regarding financial transactions.

Ever since the pandemic era started, digital wallet have become the talk of the town. But why so? What merits do they offer that make people replace their traditional leather wallets with a mere application? Digital wallets came as a new way to store all our money effectively and securely.

In this article, we will dive into the era of digital wallets and learn how they changed the world for the better.

Introduction to Digital Wallets

A digital wallet or an electric wallet is an application that allows us to make financial transitions securely right through our mobile phones. And you can do this by simply scanning a QR code; it’s just that easy.

These applications can store everything from our account information, transaction history, payee information, bills due, and outstanding ones as well.

Digital wallets save a digital copy of our credit cards and debit cards, so we don’t have to carry our cards around everywhere, allowing us to pay for our purchases at any online website or retail shop.

These wallets are connected to your mobile number and can be accessed from any device after successfully logging in to the application.

In addition to credit and debit cards, you can keep a variety of other items in a digital wallet. For example, you can store a gift card, a membership, a loyalty card, a coupon, an event ticket, a plane ticket, and even more. Some digital wallets also support integration with your BTC wallet for instant payments.

There are certainly no limits to the number of digital wallets you can have at once. But it is important to have the ones that provide security to your bank accounts and financial information. With that, let’s get to know why and how these applications have replaced the physical wallet that used to be in everyone’s pocket.

Advantages of Having a Digital Wallet

With digital wallets came their various advantages, which are enough for everyone to shift themselves toward a more digital way to make transactions. Given below are some major answers to its exceptional growth in the market in such a short span of time.

- Eliminates excessive exposure to personal and financial information: Transacting through digital wallets allows you to securely access your credit and debit cards without providing exposure to them, reducing the chances of theft.

- Eliminates the need for physical wallets and cards: Keeping bank cards and IDs on your mobile device allows you to carry less, reducing the risk of losing these items.

- Improve access to financial services: By having digital wallets on your side, you can get instant access to financial services. With these, you will no longer have to worry about having spare change for smaller purchases.

- Enhanced security: The transactions are done through digital wallets along with the whole application, and are end-to-end encrypted with advanced technology to ensure your information stays with you and you only.

- Environment-friendly: Going digital promotes the idea of paperless transactions. The government anticipates a day when cash will be partially eliminated from the economy, and most transactions will occur through digital wallets.

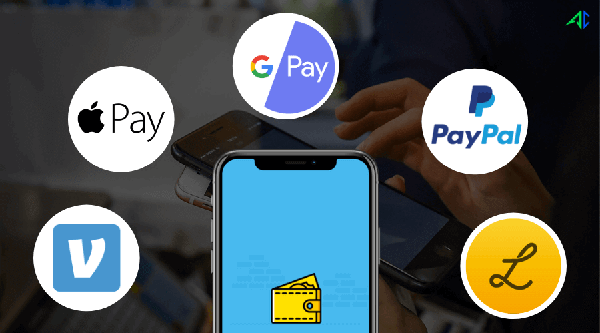

Popular Digital Wallets in the Market

Now that you have an idea of what digital wallets actually are, let’s look at some of the top examples that are favored by a large population in the world.

Apple Pay

Apple Pay is one of the top digital wallets on the market, but it only works on iOS devices such as the iPad, iPhone, and Apple Watch. You can add money to your Apple Pay Wallet to make instant payments without much hassle. Apple Pay can be used anywhere you want to make a contactless payment, as well as on websites, by choosing the “Apple Pay” option.

Apple Pay uses DPAN (Device Primary Account Number) technology to keep your account information safe by changing your account number and encrypting your data. To have maximum security with minimal effort, Apple Pay payments are verified using Touch or Face ID.

Google Pay

Google Pay, similar to Apple Pay, uses DPAN technology to protect your financial data. You can use Google Pay to deposit money into your own digital wallet or to add credit cards, debit cards, bank accounts, and more. It also uses NFC technology, so you can use your fingerprint or a password to pay, and your card details are always secure.

You can use Google Pay on your iPhone or Android device. Businesses can also use Google Pay to link up their loyalty rewards with their customers. With Google Pay, you can use your email address to access your account online. This way, you can log in to your Google Pay account from any device, including your desktop.

PayPal

PayPal is one of the first-ever digital wallets to come on the market, allowing users to make online payments and transfer funds. It works on both Android and iOS devices. You can also use and log in to your PayPal account to other digital wallets such as Apple Pay.

It is more often used by enterprises to pay their employees as it offers the feature of recurring payment. For businesses to make PayPal transactions, there is a small fee included in every payment. For consumers, there’s an instant transfer fee instead of the usual one-to-three-day free transfer.

Key Takeaways

A digital wallet is an app that makes your daily transactions a lot easier and quicker. It can be used with any connected device.

There are quite a few benefits to using a digital wallet. You don’t have to fill in your card details whenever you go to the store. Nor do you have to check every one of your pockets for some spare change.

Instead, your bank accounts and cards are stored in one secure, central location, ready to be used. Your card number is never saved in the app itself. Instead, it’s assigned to a unique virtual number, which keeps your money safe even if your smartphone gets lost or stolen.

But in the end, even though a digital wallet is a great power in itself, always check the legitimacy of the digital wallet issuer before using it. Stay informed and away from fraud!