- Robust Identity Verification (IDV)

- Prudent Monitoring of Financial and Credit Reports

- Leveraging Identity Verification Software

- Prudent Embrace of Online Document Verification

- Knowledge-Based Authentication (KBA)

- Embracing Know Your Customer (KYC) and Anti-Money Laundering (AML) Protocols

- Validation of Customer Data through Smart Link

- Empowering Customers to Prevent Identity Fraud

Identity fraud in the digital era has emerged as the biggest problem for consumers and businesses alike. Data can be misused in multiple ways by sly hackers and therefore, creating a robust strategy is paramount.

Securing private information which includes your name, address, contact numbers, banking details, etc. Imposters use these reports to get access to pins and other details to steal money. There are simple and effective measures that can be taken to safeguard private information and prevent financial loss.

This article will be your guide to identifying security lapses and creating checkpoint strategies to prevent any future disruption. This will foster a trustworthy connection with investors for consistent business growth.

Robust Identity Verification (IDV)

One pivotal cornerstone in the endeavor to thwart identity fraud is the implementation of robust Identification Verification (IDV).

The primary objective of IDV is to substantiate the veracity of claims made by individuals engaged in various processes. Thoroughly checking IDs puts a stop to scam artists trying to play the system.

IDV digs into both the tangible stuff like your passport and the bits and bytes of data that live online. When we talk about IDV, things like your passport fall into the physical category, while any details tucked away in a database are considered digital.

Therefore, the integrity of the physical infrastructure supporting your network is significant. The use of high-quality power accessories, such as reliable AC cords for network devices, plays a subtly pivotal role in enhancing the overall safety of your digital environment.

We’ve got to closely inspect each piece of evidence to spot the fakes because let’s face it, a single phony passport could open the floodgates to all sorts of identification loss nightmares.

When you nail down solid IDV checks, only the real deal customers get through the door, slashing the odds of bad guys messing with your system.

DO YOU KNOW?In a recent survey, 805, 000 instances of identification theft were reported from January to September 2023.

Prudent Monitoring of Financial and Credit Reports

Businesses, especially in the finance game, can get hit hard by identity theft. To protect your business, keep a sharp eye on your credit reports and financial statements.

Diverging from credit card fraud aimed at individual consumers, business credit fraud has the potential to affect multiple entities, and by extension, imperil a company’s reputation.

Unscrupulous individuals may engage in unauthorized activities surreptitiously, leading to the perpetration of fraudulent transactions.

Therefore, it is of paramount importance to periodically scrutinize statements associated with business credit cards, assiduously searching for any unfamiliar charges. Using online banking, you can check your accounts every week and spot any odd charges right away.

It’s also smart to switch up your passwords now and then and stay sharp when you’re taking orders. Timely reporting of any discrepancies to the relevant credit card company serves to expedite damage control.

Leveraging Identity Verification Software

Identity verification software plays a key role in making sure that the people we meet online are really who they claim to be.

Given the ease with which counterfeit identities can be fabricated in the digital realm, it becomes imperative to validate that online personas align with real-world identities.

Businesses utilize a variety of methodologies to verify identities.

Adopting IDV Software is a strategic move for businesses aiming to minimize fraud and boost consumer confidence simultaneously.

To stay one step ahead of the constantly growing attempts of sly fraudsters, businesses must opt for an ID validation provider that consistently tightens safety measures.

Prudent Embrace of Online Document Verification

Online Document Verification represents a prevalent modality for customer authentication. Online validation can help, but also creates hassles that could take time for confirmation.

Though this method tightens up security, it can also lead to a few hiccups in how smoothly users get things done. Therefore, it is imperative to strike a judicious balance between security and user experience.

Moreover, companies need to stick strictly to GDPR rules when they handle sensitive personal info during online document checks.

Knowledge-Based Authentication (KBA)

Efficacious decision-making predicated on the composition of identity represents another necessary facet in thwarting identification fraud.

Diverging from reliance on binary “match/match” or “pass/fail” outcomes, it is judicious to consider a more holistic evaluation of ID composition.

Dynamic Knowledge-Based Authentication (KBA) emerges as a formidable stratagem when confronted with suspicious identification attributes.

These queries can only be addressed by authentic users, thereby introducing an additional stratum of security to the authentication process.

Embracing Know Your Customer (KYC) and Anti-Money Laundering (AML) Protocols

Embracing customer screening supports business integrity. KYC rules are like a strong shield, keeping shady types from hiding where their dirty money comes from and making sure we’re all playing by the government’s rules.

Anti-Money Laundering (AML) rules work hand-in-hand with KYC to stop dirty money from masquerading as clean cash. Sticking to these rules is key to keeping a business’s good name and wallet safe.

Validation of Customer Data through Smart Link

Leveraging Smart Link is valuable—it thoroughly checks customer details against a vast data trove to keep identification hacking at bay. To securely connect consumer data, Smart Link cross-references information across databases.

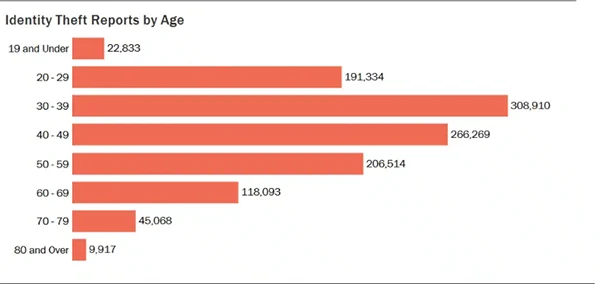

The graph below shows how common stealing personal information has become, due to which people of different age groups suffer.

Empowering Customers to Prevent Identity Fraud

Beyond what companies are doing, you’ve got power, too; make sure to stay ahead of the game and protect your identity. Here are some pragmatic guidelines:

- Securing Mobile Devices: Users are advised to employ password protection and/or fingerprint identification for their mobile devices. Protecting your private details, especially when you’re hitting up those online banking apps, is super relevant.

- Prudent Document Disposal: The conscientious disposal of credit card, bank, and investment statements can mitigate the risk of identification theft. Shredding documents that contain personal information is strongly recommended.

- Vigilance Against Phishing Scams: Consumers should exercise discernment when confronted with emails or text messages bearing suspicious links or attachments. Be on guard against phishing attempts; they’re a real threat to your info, and always verify messages before you click any fishy links.

- Guarding Against Over-the-Phone Scams: Fraudsters often impersonate bank or credit card company personnel over the phone. Users are urged to solicit credentials from callers and independently verify their authenticity by contacting the associated institution.

- Prudent Handling of Documents: Physical documents carrying sensitive information, such as name, address, and bank account details, can constitute a safety risk if not managed diligently. The practice of refraining from leaving mail in letterboxes is advised, and opting for digital statements can substantially reduce the paper trail and exposure.

- Maintaining Vigilance: The safety of personal data should never be taken for granted, as malevolent actors tend to strike at inopportune moments. When you get ahead of the game in safeguarding your data, it’s tougher for hackers to make you their next victim.

Battling identification hack calls for a sharp strategy—tight verification processes, unwavering vigilance, and strict adherence to regulations are non-negotiable.

By teaching customers how to protect themselves and blending that with strong security checks, companies can step up their game against identity theft.