You might have heard of purchasing the dip if you invest in stocks. What’s the significance of purchasing dips?

Purchasing the dip effectively follows the investment strategy of selling high as well as buying quite high.

Say it differently, it signifies purchasing stocks at decreased costs, which will consequently let you earn cash out of your investing.

Now that you are aware of what the drop means, you have to realize it’s like timing the market.

Right here you’re attempting to determine the way the stock market is going to react in the future and make purchasing and selling selections based on that.

The method of purchase, as well as holding, differs from purchasing and selling, as you invest at a dip strategy.

What is the Meaning of Buying a Dip in Bitcoin or Crypto?

Purchasing the drop is a conventional portrayal utilized in the financial markets to figure out the accumulation of assets in time of a short-term price decline.

This doesn’t usually happen once the industry is bullish, along with a bearish or maybe bear market results in a prolonged period of decreasing costs.

A bull market, however, is a period where the gold price is at its peak.

Professional investors generally purchase once the cost declines to market and then make an income afterward when the cost of the cryptocurrency goes up.

Once the markets drop, buying the dip is often nerve-racking since it’s difficult to explain when the drop ends.

Cryptocurrency investors frequently relate to this as “trying to get falling knives.”

A lot of investors would prefer to hang on to the asset to get to a place in which the price will bottom before purchasing the drop.

Waiting for consolidation (minimum volatility period) provides them with a broader opportunity to buy at the regional bottom before reversing the upside.

DID YOU KNOW? According to crypto data firm Chainalysis, around 20% of Bitcoin has been lost or is stuck in wallets that can’t be accessed. Today that equates to 3.76 million BTC (worth about $190 billion).

What are the Risks Associated with Buying a Dip?

There are numerous risks that an investor may have to confront whenever they decide to purchase the Bitcoin dip/cryptocurrency dip.

Much of the risk comes from mistakes in the evaluation. Purchasing the drop may work out more effectively in some market conditions.

If the investor doesn’t properly understand the marketplace condition, they might lose extra money.

Bing in the dip also requires a rules-based method, so the investor recognizes when to go into the market.

If the investor doesn’t stick to their very own regulations or doesn’t have some guidelines regulating their method, then the chance of loss is much greater.

Moreover, the instabilities of a cryptocurrency cause it to be tough to find out in case Bitcoin is going through a modest drop and in case a bigger effect on the cost is imminent.

When the next alternative is taken into account, buying way too soon in the crash can expose the investor to an especially big loss.

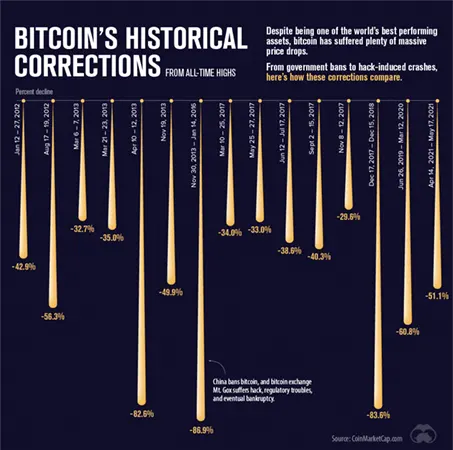

Bitcoins Historical Price Drops

Is It a Good Idea to Buy a Dip?

Basically, cryptocurrency trading differs from stock markets, but technical analysis can give invaluable insights into the way the market responds to an alteration of mood.

An investor may be enticed towards purchasing a dip of cost blindly, once the cost of the token is decreasing, but this may not be the best choice.

The cryptocurrency marketplace is likely to drop even more down the chart, which may look like you are losing cash.

The cryptocurrency market is likely to drop more and more down the chart, which might end up in losing your money.

The market value of crypto is impacted by a variety of factors, apart from the dominant industry view.

Consequently, before you place yourself in a package of risks, do a little investigation all by yourself.

Frequently Asked Questions

Ans: As it is the largest crypto by market cap, any price variation tends to influence the price of other cryptocurrencies too.

Ans: As Bitcoin is the main market mover in the world of crypto. If it falls, it may be an indication for other cryptocurrencies to fall as well.

Ans: There have been cases of many cryptos to keep falling after the initial drop. Investors and traders need to keep in mind that like any other publicly traded asset, crypto can fall too. All past and future predictions need to be researched before considering “buy the dip”.

Ans: Buying crypto in the dip has proven to be very successful in 2023. The gains are almost as good as that of 2021. Plus, many researches indicate that buying the dip has provided better returns than buying when the market is on the rise.