Cryptocurrencies have appeared as a disruptive force in the dynamic landscape of modern-day finance. It challenges the conventional notions of the monetary system with the perplexing realm of cryptocurrencies.

Along with this, the cryptocurrency exchange development is another complex fusion of cutting-edge technology. Cryptocurrency apps such as BitBot App are becoming increasingly popular sources of income for many individuals. These assistants help make informed decisions.

Let’s dive in and navigate through the exchanges and wallets for beginners.

What are the Cryptocurrency Exchanges?

Cryptocurrency operations are quite similar to the stock exchanges. These exchanges are of three types, centralized, decentralized, or hybrid. Its functioning is very similar to the conventional financial networks, where the transactions are supervised by a single entity.

On the other hand, smart contracts are used by decentralized exchanges to facilitate trade and to run a single central authority independently. Also, in the case of hybrid authorities, both elements are incorporated.

Top Factors to Monitor in a Crypto Exchanges

Whenever cryptocurrency exchange occurs, you need to sign a reputable cryptocurrency exchange. Here, the exchanges act as a platform for trading those digital seats. Therefore, it becomes very important to choose a method of exchange with supported cryptocurrencies and user-friendly interfaces. Some of the other factors that should be taken into consideration are as follows:-

- Best security measures:- To safeguard your digital asset, you must deploy a strong and unique password for your account. Don’t forget to enable 2-factor authentication. Also, be cautious regarding the phishing attempts, and make sure you download the wallets from official sources.

- Regular Updates:- Because cryptocurrency is dynamic with consistent development, it is necessary that you keep yourself updated with the latest modifications.

Follow up the social media platforms and other sources of communication to get regular updates.

- Evaluate token fees at DEXs:- Various DEXs (Decentralized Exchanges) are available, which charge lower fees than the centralized zones. It is because they have eliminated the intermediaries. So, picking them can also help you to invest better and create possibilities to yield profits.

- Stay logical while investing:- Whenever the market is very volatile, investors usually get emotional regarding picking safe investing points. Since impulsive decision-making tends to yield more losses than gains, it is better to set clear goals and stick to a disciplined approach.

Invest your time into learning the fundamentals and have a long-term perspective regarding your investment patterns.

📓 Note:-

Always remember that the cryptocurrency is one aspect of your financial journey. Diversification is something that you need to implement and embrace.

These are the crucial factors that you need to consider when you are planning to work with cryptocurrency exchanges.

How Do These Cryptocurrency Wallets Work?

Do You Know?

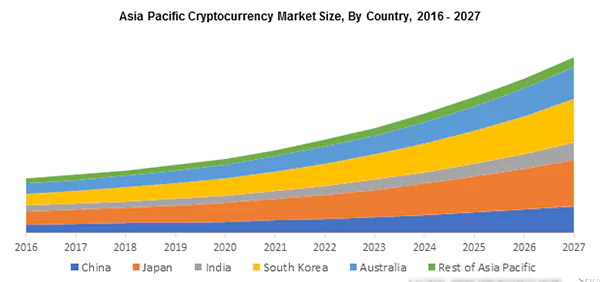

According to Global Market Insights, the cryptocurrency market size is projected to register gains at over 10% CAGR from 2021 to 2027.

Firstly, you need to understand that wallets are not something that holds the coins of the users. It holds a key to the coins that are stored in the public blockchain networks.

Therefore, whenever you need to make a transaction, you will have to verify your address with your private key, which has a specific set of codes. The wallet also defines the security and the speed of the transactions.

Types of Cryptocurrency Wallets

The software-based hot wallets and cold wallets are the two types of crypto wallets available. Their connectivity with the internet is the major criterion for deciding what type of wallet it is. Primarily, hot wallets are connected to the internet, whereas cold wallets are kept offline.

Here, it also highlights a flaw of a hot wallet, i.e., it is easier to access to the hackers because it is connected via the internet. Such as mobile wallets, desktop wallets, web-based wallets, etc.

📓 Note:-

In hot wallets, the encrypted private keys are stored online on the app itself. Therefore, using these wallets is riskier since the hackers can target the hidden vulnerabilities of a computer network to break the system.

So, for the safer end, you should avoid the practice of keeping large amounts of cryptocurrencies. Otherwise, you can implement the practice of using stronger encryption or storing private keys in a secure enclave. There are so many reasons why you might consider choosing cryptocurrency wallets, either hot or cold ones.

Wrapping Up

To sum up, it is understood that the cryptocurrency exchange is one of the vibrant and diverse fields. The more you invest in educating yourself would help you to adopt a long-term perspective regarding the investments.

Since everyone has their unique experiences here, hence, you need to embrace the process of learning. Always be prepared for the exciting possibilities that the investment world has to offer.

Happy investing!

Also Read: Top 5 Crypto Exchanges You Can Trust in 2024