Interest in cryptocurrencies has grown tremendously in recent years. With this staggering rise and fall of digital assets like Bitcoin and Ethereum, a serious question arises in every trader’s mind i.e.: Do I have to pay crypto taxes?

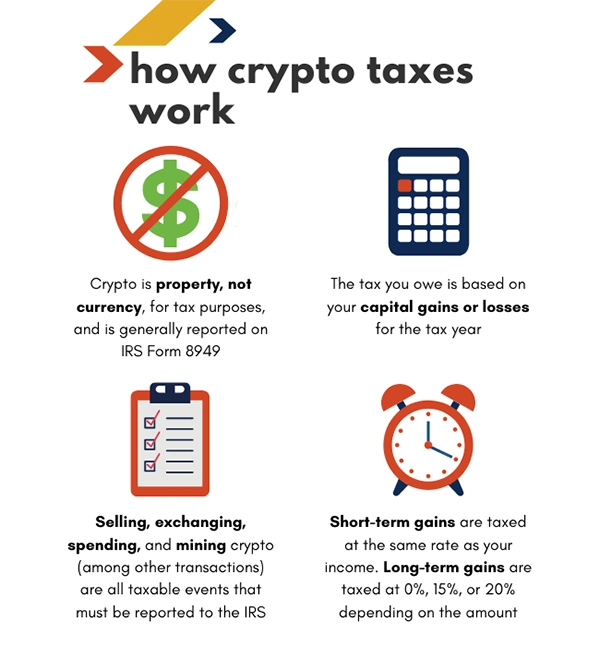

The IRS released its very first cryptocurrency guidance in 2014 and according to IRS Notice 2014-21, they treated digital currencies as “property”. Even, they are given the same treatment as stocks, bonds, or gold. Meaning, that when you buy, sell, or exchange it, you may owe tax.

Since then, the community of crypto has gone through increased enforcement, audits, and regulations. When you decide to sell digital assets you likely need to file the associated taxes, which is often known as capital gains or losses.

We understand that dealing with financial liabilities associated with virtual assets, especially as regards blockchain jargon like staking airdrops. But, being a taxpayer or entrepreneur is vital to comprehend these.

For that reason, we are here to guide you on how to report and manage your cryptocurrency tax.

The IRS Classification of Cryptocurrency

In the IRS 1040 Form instructions, virtual assets are described as “any digital representations of assets that are recorded on a cryptographically encrypted distributed ledger or any similar technology. For example, they include non-fungible tokens (NFTs) and virtual currencies such as stablecoins and cryptocurrencies.

If a particular asset has the characteristics of a digital asset, it will be treated as a digital asset for federal income taxation purposes.” This form indicates that taxpayers can no longer claim to be unaware that Bitcoin transactions must be reported.

When taxpayers don’t report their taxable transactions, the IRS might impose penalties on the underreported taxes.

What are the Taxable Cryptocurrency Transactions?

Not all digital money transactions are taxable. Some non-taxable events include:

- When you BTC buy or buy other virtual assets with cash.

- When you transfer them between accounts or wallets you control.

- When you accept large gifts triggering other types of tax obligations.

Do You Know?:

From 2023 to 2024, the subject to the per-person gift limit of cryptocurrency is $17,000 for the 2023 filing and $18,000 for the 2024 filing.

- When you donate a virtual currency that is tax-deductible.

Taxable Cryptocurrencies

The following events are taxable:

- When you sell digital assets for cash.

- Trading a type of cryptocurrency for another.

- Using it as payment.

- Staking, mining, or receiving airdropped tokens.

- Being paid in the digital currency.

- Receiving yield or interest in a digital asset.

Reporting Cryptocurrency Taxes

You ought to continue to be organized throughout the year to be accurate when reporting your earnings and losses. Find a way to do it by yourself and get assistance from a blockchain solution platform available online. Generally, you are required to report every digital money transaction on the following forms:

- Gains that are categorized as income are reported on Schedule 1 when you receive them as an employee.

Fast Fact:

For the 2024 tax year, the profits on the sale of assets held for less than one year are between 0% and 37%, it further depends on your income.

- Gains that are categorized as income are reported on Schedule SE and C when received as self-employed entities.

- Capital gains tend to be reported on Form 1040 (Schedule D). You might likely be required to complete Form 8949 first before you can accurately fill Schedule D.

Calculating Crypto Gains for Taxes

Usually, an exchange or brokerage platform can send you your yearly statement that details your gains and losses. When they do not do that, you can calculate your taxable income with tax preparation calculators.

Take note that there are two different capital gains rates for digital assets: short-term capital gains and long-term capital gains.

IRS withholds short-term gains at the same rate as a person’s income tax bracket. Find the table below to learn how short-term capital gains penalty rates for 2024 compare by filing status:

| Short-Term Capital Gains Tax Rates 2024 | |||

| Rate | Single Filers | Married Couples Filing Jointly | Head of Household |

| 10% | Up to $11,600 | Up to $23,200 | Up to $16,550 |

| 12% | $11,600 – $47,150 | $23,200 – $94,300 | $16,550 – $63,100 |

| 22% | $47,150 – $100,525 | $94,300 – $201,050 | $63,100 – $100,500 |

| 24% | $100,525 – $191,950 | $201,050 – $383,900 | $100,500 – $191,950 |

| 32% | $191,950 – $243,725 | $383,900 – $487,450 | $191,950 – $243,700 |

| 35% | $243,725 – $609,350 | $487,450 – $731,200 | $243,700 – $609,350 |

| 37% | $609,350+ | $731,200+ | $609,350+ |

Whereas, they penalize long-term gains at a lower rate. This is done to encourage investors to hold on to their assets. Find the table below to learn how long-term capital gains taxable rates for 2024 compare by filing status:

| Long-Term Capital Gains Tax Rates 2024 | |||

| Rate | Single Filers, Taxable Income Over | Married Couples Filing Joint Returns, Taxable Income Over | Heads of Households, Taxable Income Over |

| 0% | $0 | $0 | $0 |

| 15% | $47,025 | $94,050 | $63,000 |

| 20% | $518,900+ | $583,750+ | $551,350+ |

There are various software options that allow you to calculate digital currency calculations.

To use tax preparation software for calculating crypto taxes, you will first require details of your crypto purchase or trade. It usually includes the date and time, cost basis, and fees. If you bought through an exchange, you can access this detail from your account.

Many exchanges keep this data ready to download as a .csv file, and these tax-filing services allow importing .csv files.

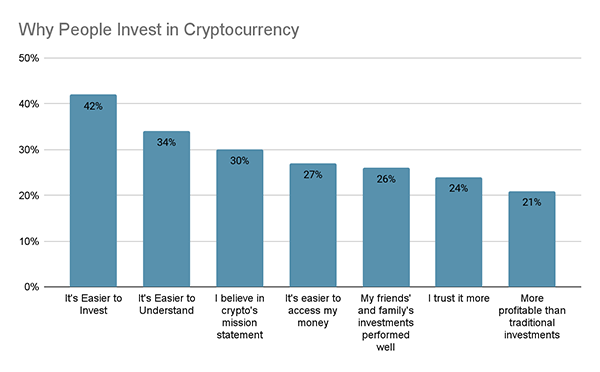

Statistics:

According to the latest survey conducted on why people invest in cryptocurrency, over 42% of people stated that it’s an easier way to start investing through an app.

When the data is synched, the calculator will help you figure out the taxable amount based on the gains and total taxable income. However, sometimes, the calculations might not be accurate.

Ensure that you check every entry in the system against the information from your exchange profile. Remember that it would be easy to work with a professional and licensed regulatory officer to reduce any possibility of errors.

Endnote

Cryptocurrency taxation is a complicated field due to the involvement of both capital and income gains taxes. In many instances, you might be taxed several times for using the virtual currency. Consult with a professional accountant who is familiar with the current practices in digital currency tax to ensure you report your taxable income correctly.