Bitcoin is not only the first cryptocurrency in existence, empowering the creation of the projects that followed in its footsteps.

It is also the asset dubbed to come as close as gold in terms of potency for portfolio diversification, so it’s no wonder that investors look to accumulate Bitcoin for long-term benefits.

Most fiat-to-crypto exchanges enable users to buy Bitcoin with debit card since this payment method is convenient and affordable for any interested party. It is also one of the most preferred in the crypto community, as the process is as easy as linking the card and sending the order.

Spreading payment options is indispensable to helping cryptocurrency exchange platforms stand out in the competition to serve more customers and increase customer retention rates.

Experts and analysts debate even if a bull run is coming and when it may arrive.

DID YOU KNOW?

Around 20% of all existing Bitcoin has been lost forever.

As such, more investors are pondering if now is the time to get involved with cryptocurrency or wait until the light at the end of the tunnel shows signs of visibility.

Suppose you are among the wishful thinkers who believe the bull market will arrive by the end of 2023 or 2024 and are torn between different payment methods for your Bitcoin portfolio additions.

In that case, you need to know which one is among the most used. Here’s what you should know about Bitcoin purchases made with debit cards to see if they are the option that best suits you.

Reasons Why Bitcoin Holders Utilize Their Debit Cards

Debit cards are among the go-to options for cryptocurrency owners since they’re convenient, make transactions fast, and allow instant access. They’re accessible and intuitive to use for both rookie and seasoned investors.

Plus, they’re familiar and accepted by almost any cryptocurrency provider, making it easier to break into the crypto world before choosing a debit card-friendly exchange.

Compared to other payment options, credit cards are among the fastest.

This lets everyone profit from sudden market fluctuations to generate a quick buck.

Besides convenience, ease of use, and instant access, debit cards are also helpful in urgent situations when you may need to seize an opportunity in the shortest period possible.

What to Consider When Comparing Various Platforms That Let You Use Your Debit Card

While there are numerous platforms where you can use your debit card, the top ones should provide the lowest fees, the fewest limitations, and the highest security measures.

Fees

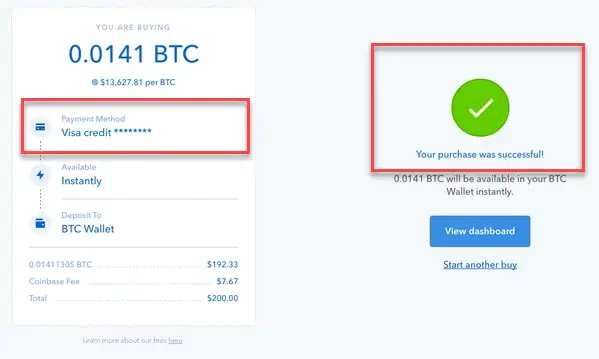

Different ways to buy Bitcoin when using your card company include Google Pay, Apple Pay, credit cards, or debit cards. When the purchase is finalized, your order will enter your digital wallet.

Fees are among the first things that cross a customer’s mind before completing an order. This is a necessary factor since different crypto exchanges have diverse fee structures and limits regarding debit card purchases.

For instance, some providers may impose a flat fee or a pre-set amount that will be taken for every transaction, regardless of how much Bitcoin is being bought. You may purchase a small or large amount – the fee will remain the same.

Since different crypto platforms or exchanges charge different fees, comparing them before jumping on a service provider is significant. They differ from other fees like withdrawal or processing fees or exchange rates, which are also factors to consider when using a debit card.

On the other hand, some providers charge a transaction fee percentage. For instance, some platforms may charge between 0.05% and 0.25% for purchases or sales of Bitcoin.

This is generally taken to process your transaction and cover the payment.

You may encounter more types of fees when buying Bitcoin with a debit card, such as deposit fees, card issuer fees, or currency conversion fees. This makes pondering this aspect necessary before picking out a cryptocurrency platform.

Limitations

You may also encounter a situation where you’re faced with a limit on how much Bitcoin you can buy with a debit card. For instance, some exchanges may have monthly, weekly, or even daily purchase limits.

In some cases, they differ significantly depending on different factors, such as the platform’s policies or your transaction history.

You may also be subject to withdrawal restrictions, as some crypto exchanges have these limits for customers using debit cards. This may prevent Bitcoin withdrawals for a specific period, hampering your flexibility.

Last but not least, you must ensure that the crypto exchange you’re eyeing accepts your debit card. Not all debit cards are supported by every platform.

Before committing to their services, you should research and fully understand an exchange’s structure and policies.

Security Features

Security is another major aspect that shouldn’t leave your mind on your journey to find the best platform to use your debit card for Bitcoin orders. Check that the provider you’ve laid eyes on has strong security measures in place, such as safe storage of cryptocurrencies, encryption of sensitive data, and 2FA.

Additional security measures are also welcome, such as using a provided hardware wallet or having insurance coverage for the assets.

The latter will help you better protect your Bitcoin or other cryptocurrencies.

Some platforms use liveness detection, which is better than selfie verification. If you’re pondering between two platforms that differ in this regard, consider the one that checks the former feature.

DID YOU KNOW?

There have been a total of 668 million Bitcoin transactions since 2009.

What You Should Pay Attention To

There are also downsides to using debit cards, just as no payment option is flawless. Fees can be higher than you’re comfortable paying, so you should consider this.

On the other hand, this shouldn’t be the only consideration when opting for a provider. The security provided, reputation, media exposure, and user-friendliness also matter when choosing a crypto exchange or platform.

Other risks associated with buying Bitcoin or other cryptocurrencies with debit cards are associated with market regulations. Only some platforms may operate in your state, as the crypto market lacks regulation in most parts of the world.

This may create room for fraud and scams, meaning you should dig deeper when eyeing a provider.

It’s necessary to conduct thorough research and do your due diligence to overcome any potential challenge or risk.

Paying for Bitcoin with debit cards can be a convenient and easy method, assuming you bear in mind the considerations above.