Cryptocurrency has become a trendy term in the market areas, and almost everyone is considering investing in this currency ecosystem. The introduction of digital money was one of the most revolutionary moments that have ever been observed universally, which has affected global systems, monetary usage, trading and investing methods, and many more. Also, you can check here should Banks ban Bitcoin.

Trading is part of the worldwide dealing that gained the most reforms from its implementation, and various remarks have been observed since this implementation was done. What were these changes, and how did the platform evolve into something more beneficial than before? The journey of being practically from scratch to one of the most demanded currency alternatives in the universal platform is quite fascinating.

Introduction, and Challenges for Cryptocurrency Globally!

Implementing online currencies in the market is not as easy as other fiat assets. They are not centralized, so there is no authorized power or governmental support to raise this money. Are you interested in bitcoin trading? Therefore, its implementation and evolution came from several reforms and its motto of creating a secure and anonymous economic and financial systems platform.

It was one of the first digital currencies introduced and made public with ledger technology. Its developers developed this token with cryptography, where pairs of data bits are shared between two parties. Each owns a private key for enormousness and a public key for verification.

Initially, the growth of BTC was sluggish because these are new forms of its alternative, and being online, they practically have minimal value to be used in the trade. Another factor to consider is that people still tend to continue with fiat assets, and a new currency is not viewed as profitable, which drags down the growth of Bitcoin.

However, over time, certain people showed interest in this alternative because of its unique concept and implementation. They tried giving it a shot as the benefits of using BTC were introduced, including decentralization, volatility, digital mode, etc., along with the revolutionary blockchain technology, which still has its share of appreciation and modeling.

Do You Know? There are more than 12,000 cryptocurrencies in existence. While you can’t buy them all on an exchange, some of them require their wallets.

The Birth of the Crypto Trading Market

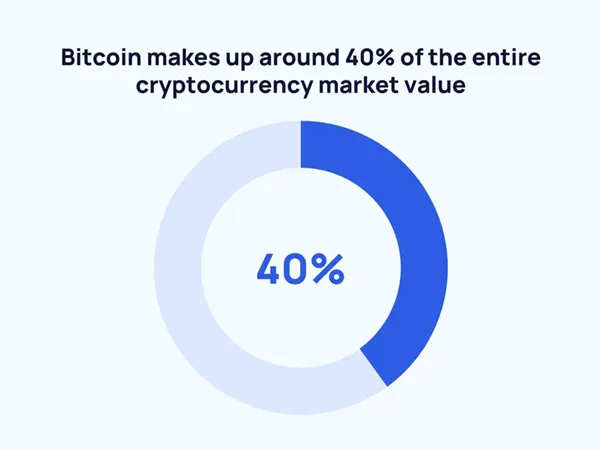

(The global cryptocurrency market cap (as of October 2023) is $1.1 trillion, where Bitcoin’s market cap of $531 billion accounts for around 40% of the total).

With the growth of them in the trade, many people used their own Bitcoin in trading and other everyday use market areas. As a result, the use of them and other cryptocurrencies in the industry grew gradually.

Witnessing the colossal demand and value of Bitcoin, other currency alternatives with almost the same design and features appeared in the trade.

For example, Ethereum, which is extra functional and adaptable, began appearing in the industry area, fueling the need to accept crypto prices in the trading platform. Besides, virtual tokens in dealing are accessible and prevalent as the surge of virtual money continues because of decentralization.

Unlike the forex or stock market, which predominated the global trade, crypto dealing is more volatile in a specific period, which generates a significantly considerable profit margin, luring several prominent trader communities in this digital trading area.

In addition, dealing in the area proved to be more prominent than investing in this currency alternative because it is short-term, and hence, traders can perform many trades in a given time.

The Bottom Line

Undoubtedly, Cryptocurrency trading is the foundation of technology-driven markets and has the potential to change marketing strategies. Though, these digital assets are secured with cryptography, understanding the risks involved with them is fundamental.

FAQs

Ans: Though cryptocurrency is available in low or middle-income nations, certain developing countries are still not aware of this technology and the associated risks. Another major challenge is a weak security system that makes cyberattacks highly vivid.

Ans: They were invented to lessen the restrictions on financial transactions, making them highly flexible and less dependent on banks or governments.

Ans: Several factors make crypto important such as fast transactional speed, cost-effective transactions, a decentralization model for money, portfolio diversification, easily accessible, safe and secure, and more.