Bitcoin is a pioneer in cryptocurrencies with the rise of interest in Bitcoin. Trading has become a side gig to generate extra income. Its meteoric rise in popularity makes it the most valuable cryptocurrency in the world. Even, considered a highly volatile asset. On the contrary, it is famed even because of the risks associated, which often attracts traders globally.

Traditionally in 2010, Bitcoin traded at less than $0.01, but in 2021, the prices were above the $40,000 mark. Hence, proves the upside-down journey of it with one constant market volatility.

This detailed guide will let you know why one should approach Bitcoin trading cautiously regardless of beginners and experts alike and the platforms to choose for Bitcoin trading.

How To Start Bitcoin Trading?

Bitcoin trading is not rocket science. With the availability of platforms like Bitcoin Sprint Website which makes the world’s most popular cryptocurrency accessible to all. Regardless, anyone can start trading by following four steps:

Analyze the way you want to trade Bitcoin

The traditional way of trading includes buying and selling cryptocurrency on an exchange. But the contemporary approach has a different take on it. Nowadays, you can make money by speculating on Bitcoin price fluctuations using CFDs.

This is possible because CFDs are traded over-the-counter (OTC)Which means anyone can take a position on market moments without facing a need to buy and sell on an exchange. Even, CFDs are leveraged, demonstrating that margins are open.

Did You Know?: When Russia attacked Ukraine, on 2nd February 2022, the prices of Bitcoin went down.

However, it amplifies profits by providing you full exposure for smaller initial outlay and losses.

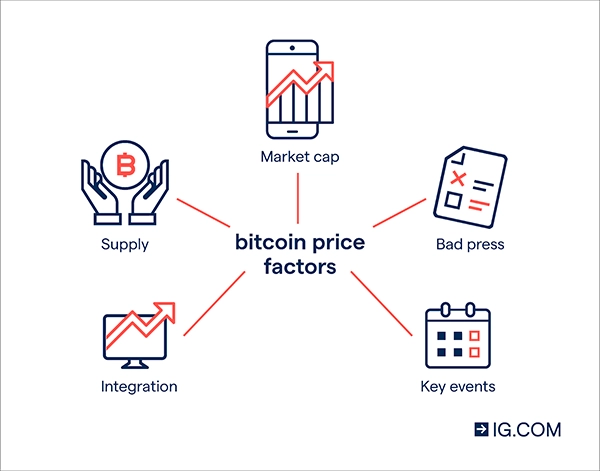

Comprehend Factors Influencing Bitcoin’s Price

At first, you need to understand and research factors that move its prices. A few of them are noted below:

- Bitcoin Supply: It is obvious that Bitcoin’s price totally depends upon its supply and demand. It always owns a finite number of supplies which indicates the price could increase if demand rises in the near future.

Did You Know?: The recent Bitcoin supply is capped at 21 million which is later expected to be exhausted by 2140.

- Market Capitalisation: As previously mentioned, Bitcoin is the largest of all and has great capitalization. The value of coins and how users perceive this to be developing. The growth in market capitalization could see Bitcoin become a more sought-after investment.

- Key Events: Events like big news and regulation changes related to Bitcoin’s security breaches and macroeconomics may affect its overall market price. Agreements between users to speed up the network could consequently raise its price. For instance, the crypto ban in China led to massive sell-offs in BTC.

- Smooth Integration: Bitcoin is something that approaches smooth transactions between two parties. That too, without any involvement of regulatory or centralized authority. Therefore, the integration into new payment systems and banking frameworks is the factor on which its public profile depends.

- Bad Press: News that concerns its security, value, and longevity will surely affect its coin’s overall market price negatively.

Bitcoin trading strategies

There are five trading strategies that will assist you in trading hassle-free.

- Bitcoin day trading: Day trading or intraday trading is one of the most common kinds. Which means traders enter and exit positions within the same day. It leads to no exposure of Its market overnight. However, one will avoid overnight funding charges on the position.

- Bitcoin swing trading: It is also known as trend trading and is a short-term approach. It demonstrates you can take advantage of short-term price patterns.

The benefits of this strategy include easy-to-grasp, less stressful, and easier market movement predictions. Swing traders make money from both upward and downward movements that occur in a narrow timeframe.

- Bitcoin scalping: This is yet another short-term trading strategy. Scalping is all about opening positions in line with a trend. This trading strategy is proven best for active day traders. Therefore, it mainly focuses on minute-to-minute price changes.

- Bitcoin hedging strategy: The hedging strategy attempts to lower the risk in the short term by hedging an existing position with a second. This will consequently let you protect yourself from unfavorable movements in the market.

- Automated trading: It uses autonomous algorithms to open and close trades. This is done according to the rules sets, such as points of price movement. Finally, if the market conditions match the predetermined criteria, trading algorithms can accomplish a buy or sell order on your behalf.

Trade Bitcoin

While trading Bitcoin via CFDs, individuals will use a leveraged derivative to speculate on price movements and avoid taking ownership of any real ones. Thus, one can go long or short on the cryptocurrency.

Conclusion

Bitcoin trading is new and largely fragmented as it is open to arbitrage and margin trading. With huge opportunities for traders for short-term profit gains, it is captivating others to start their journey by trading Bitcoins.