Complications in time zones and differing cultural norms pose a significant challenge to industrial supply chains’ smooth, seamless operation. You can check out this website to learn more about Bitcoin trading.

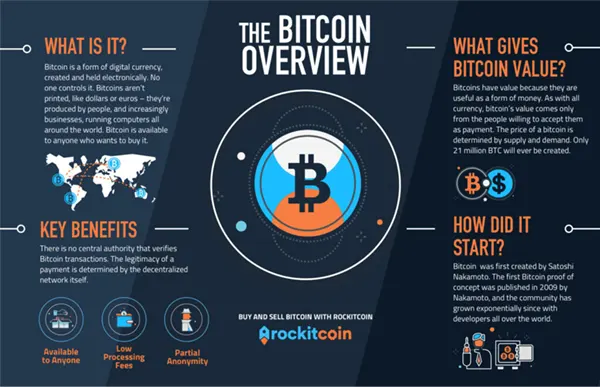

Bitcoin offers a solution. To facilitate payments across large distances, Bitcoin relies on virtual currency.

With no geographic boundaries or regulatory oversight, it allows companies to conduct business much more efficiently than has traditionally been possible with other payment methods and banks.

Users can use their knowledge of bitcoins and the blockchain technology behind them to improve their business models- or even create one out of thin air.

For example, digital currency has gathered support from global brands such as Dell, which users use for two-way computer equipment purchases.

More recently, digital currency has gained some infamy as a tool for facilitating online purchases of illegal goods and services.

DID YOU KNOW? As of this moment, 17 million bitcoins are already in circulation; that means almost 80 percent of the 21 million have already been mined.

The Open-Source Digital Currency

It’s a network of computers worldwide that continuously generates new blocks of data using algorithms similar to those used to secure banking transactions.

Users use their computers, connected to the Internet, to continually update and verify each block, which forms a virtually unbreakable chain of digital evidence.

The blockchain reveals a timestamp and transaction information for every new block in the chain, providing a publicly accessible digital ledger that is secured using cryptography.

The blockchain is effectively a giant accounting ledger that tracks all Bitcoin transactions.

The transaction is publicly updated on the blockchain whenever someone spends bitcoins and is recorded in new data blocks, forming a digital record of each transaction ever made.

Anyone can view it anytime, but hackers can’t secretly alter it without leaving a detectable trace. This key feature makes it virtually impossible to counterfeit or spend bitcoins twice.

It also allows developers to create innovative applications that take advantage of Bitcoin’s secure ledger- and there’s already a lot more potential on this front just waiting to be tapped.

Use Case of Bitcoin and Blockchain:

Many experts believe that the digital ledger is more valuable than Bitcoin.

Advocates envision a future where all manner of digital transactions are conducted via blockchain-based smart contracts, in which payments are executed automatically as soon as specific conditions are met.

The user could even use the digital currency to improve existing security systems, such as the software that protects computer networks from attack.

Still, security and compliance can be tricky issues for large companies with thousands of users and computers spread across multiple locations worldwide.

A Blockchain-based Solution could be a Massive Improvement.

Media outlets worldwide have begun to cover this emerging technology and related news in greater detail and report on companies taking advantage of it for various purposes.

Moreover, with the ability of the blockchain to make digital transactions transparent, allowing anyone to trace a sale from start to finish, this technology is also set to transform digital advertising.

None of them managed to offer a viable alternative that could have kept Napster afloat, but some new blockchain ICOs may succeed.

But, of course, the blockchain is still in its early days; right now, it’s best suited for enthusiasts willing to roll up their sleeves and work on solutions themselves.

But it’s not a stretch to imagine that the distributed ledger might be a vital part of most business systems in the future.

The blockchain has many applications, and if companies can manage to take full advantage of them, it could lead to significantly greater transparency and efficiency in nearly every kind of transaction.

Bitcoin as a Medium of Exchange:

The easiest way to understand Bitcoin is to compare it to cash. Like the Dollar, Euro, or Yen, it’s a unit of currency you can use to buy things. Any central authority does not support it and instead relies on the consensus of its users.

In that respect, it’s a lot like other digital currencies such as Litecoin and Ethereum, except for one major distinction: its adoption and massive popularity.

Also, there are no physical Bitcoins. Each is represented digitally on a computer network spread across the globe called the blockchain.

But that blockchain relies on many computers, which are constantly connected to one another. Some viewed the cryptocurrency with skepticism and fear because of its anonymity and unregulated nature.

Others saw it as a new way for individuals to evade taxes or transfer money outside their home country.

But as with other currencies, its value comes from the fact that people are willing to accept it in exchange for goods or services.

You can also use it to pay for your electricity bill or you’re shopping – a list of legitimate Bitcoin uses has grown significantly over the past several years.