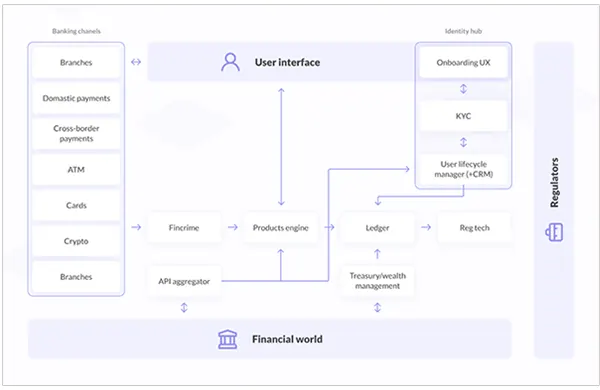

With the beginning of the new millennium, it became possible to monitor one’s own bank accounts remotely via the Internet. In the initial stage of online banking, only simple operations like money transfers and electronic payments were possible. However, the Internet banking system has evolved a lot and has expanded financial software development services, which have made mobile banking more and more attractive.

Mobile banking seems really impressive, but the question arises, “How to start?” Today’s article will specify how to start mobile banking and introduce you to the potential benefits and risks involved in it, so read on.

How and Where to Start Mobile Banking?

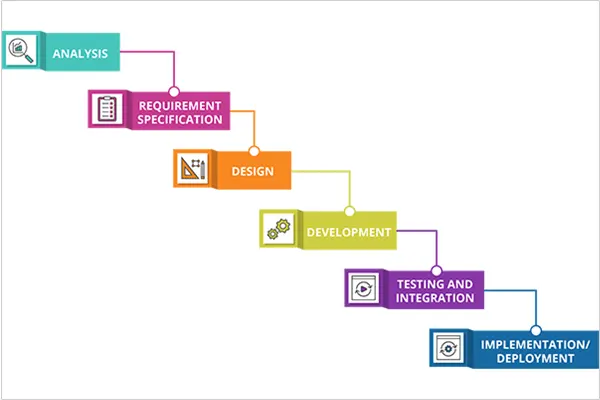

You can start mobile banking just by sitting at your home. To initiate mobile banking, each Internet user is required to register in the system of their bank. During the procedure, he will receive a login, password, and other data for entering the personal account. A person can register on the website of only the bank he is a client of.

During the registration process, the user specifies the data of one or more bank cards (only one bank), that he wants to manage remotely. All data requested by the system must be entered correctly.

- First, there may be a need to recover a login or password.

- Second, every user is checked by the bank’s security service. Registering in the Internet banking system allows a person to process personal data.

If the security service of the bank confirms the reality of the person registering, the identification process is completed. After that, you can use all the services available in the bank system. Geniusee offers a full spectrum of mobile app development services.

From a computer, it is enough to go to the bank’s website or the service it offers for remote account management. You need to install a special application to access online banking through a smartphone.

Benefits of Internet Banking

Mobile banking seems to be a boon in contemporary consumerist society. It has become an essential tool to keep pace with the highly changing world and manage your money just by sitting at home. Mobile banking has uncountable benefits, and to list a few: –

- Remote card management – You can manage your bank and check the current balance or monitor the status of this or that financial transaction at any time of the day, sitting anywhere in the world. For mobile banking, all you need is internet access. You can use internet banking services from a PC, laptop, tablet, or smartphone.

- Quick execution of financial transactions – Money transfers via Internet banking are just a matter of a few clicks. Within just a few minutes, you can make transactions of hundreds and thousands. However, more significant amounts may take longer. Through Internet banking, you can make money transfers between the accounts of the same and different banks, as well as replenish the accounts of electronic wallets.

- Payment of services – Mobile banking has made managing bills easy. Now almost all services can be paid for online without standing in queues. Through Internet banking, you can pay for utilities, top up your mobile phone account, pay for the Internet, shop online, pay fines, taxes, and more.

Furthermore, to enhance user experience, many systems have an automatic payment function. It can be activated if you need to pay a certain amount every month. Money will be automatically withdrawn from the account when the specified period is reached.

- Interaction with the bank – With mobile banking, you rarely need to visit the bank. You can remotely open new accounts, deposit money, and take out a loan through Internet banking software. Furthermore, additional documents, if necessary, can also be submitted online. Some banks even encourage customers to open deposits remotely by offering them higher interest rates.

- Minimal or zero commission – The complete absence of a commission for services rendered is rare. However, it will be smaller than the amounts taken in branches and much smaller than terminals. The size of the commission depends on the amount of the payment.

Risks of Internet Banking

Mobile banking is indeed one of the best technological advancements so far, but not everyone can get a complete hold of it. That’s why daily cases of banking and online shopping scams are reported to banks by users. Similar to other latest technologies, mobile banking also has some potential risks associated with it. Here are a few risks of Internet banking that one should be aware of while using online banking.

- Risk of losing money – Every internet banking user is at risk of being hacked. It is especially dangerous when several people have access to the computer or smartphone from which the private office is accessed. Banks regularly hire cybersecurity experts to protect users’ data, but criminals are not stopping in their creative progress.

- Limits – Banks have the right to set limits for online financial transactions. Limitations may apply to the number of transactions or the amount of money. The credit institution also has the right to block a dubious transaction.

- Technical failures – Neither banks nor clients are immune from technical failures. Internet banking systems are constantly overloaded with users, so their work has frequent failures. Usually, specialists quickly eliminate such problems. However, there are cases when financial transactions are carried out for hours or even several days due to a technical failure.

- Impossibility of not interacting with banks at all – Internet banking has many advantages, but it cannot guarantee a person complete distance from a credit institution. There are times when certain issues cannot be resolved online. The same applies to cash withdrawals. You can manage your account through Internet banking, but you need to withdraw money the usual way – go to an ATM.

Wrapping Up

In general, Internet banking is a useful service. It saves time and sometimes energy. It is almost impossible to protect your account 100 percent. After all, banks do not force customers to cooperate with them exclusively online. Internet banking has advantages and disadvantages, and what prevails is everyone decides personally for themselves.