The price point is the main factor after the quality of the product in deciding the sales volume. Businesses must decide the right selling cost based on the competition and target customers.

Organizations can use price analytics software to set the ideal price point for their product. These software tools provide data-driven insights based on the market fluctuation for your particular product.

It analyzes the pricing of other companies of the same niche and customer response to the price.

This involves price monitoring, and historical data analysis to set the right price. In this article, we will discuss the importance and role of pricing analytics tools in setting the right price for your product and service.

Comprehensive Data Collection

These analytics tools pull together data from the various systems used by sales, finance, operations, and other departments. This can include:

- Point-of-sale data showing real-world transaction prices

- CRM data with pipeline opportunities and conversions

- ERP systems provide cost info and inventory levels

- Procurement data with supplier and input cost

- Marketing analytics on campaigns, promotions, and discounts

The analytics platform cleans, organizes, and structures the data for analysis. Complete, unified data provides the foundation for reliable insights.

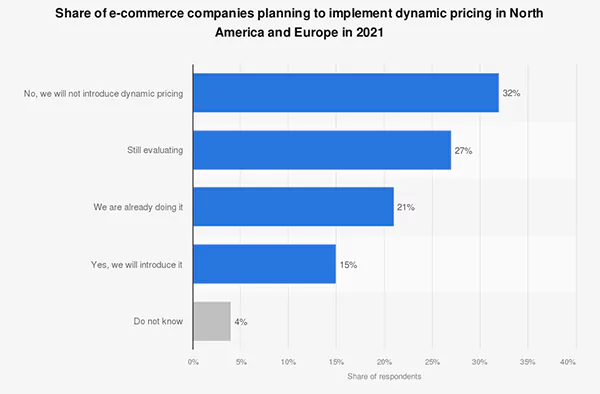

Interesting Fact

The above report of Statista shows the data of eCommerce companies that are planning to implement dynamic pricing in North America and Europe in 2021.

Ongoing Competitive Pricing Monitoring

Understanding the competitive landscape is vital for a smart selling cost strategy. Analytics tools compile up-to-date pricing for rival products and services across channels for comparison.

Key features supporting continuous competitor monitoring include:

- Price crawling that systematically gathers competitor rates from websites

- Customized price alert triggers when rivals drop or increase prices

- Competitor assessments benchmarking of your products’ selling cost against the market

This real-time monitoring informs rate of goods adjustments and strategic positioning.

Historical Trend Analysis

Pricing analytics leverage longitudinal data to uncover relevant trends and seasonal patterns. Statistical models quantify relationships like:

- Price elasticity – impacts of price changes on demand

- Price thresholds – minimum viable and maximum tolerated strategy

- Promotion lift – and incremental sales from temporary discounts or sales

The learnings from past performance help anticipate future demand curves at various price points. This data-driven analysis enables the optimization of the selling amount.

Ongoing analytics across these areas provide the actionable insights needed for smart strategy and tactical decision-making. Pricing analytics elevate decision-making to maximize financial performance.

Granular Customer Segmentation

Customer segmentation divides clients into cohorts with distinct willingness-to-pay and price sensitivities. Analytics assess past purchasing behaviors to assign customers. Typical segments include:

- Price-sensitive buyers who gravitate toward discounts

- Premium buyers willing to pay for added features or quality

- Loyal, repeat customers who trust your brand

- Volume purchasers focused on bulk or bundle deals

Segment-specific pricing maximizes revenue based on perceived value for each group.

Predictive Price Simulation

Price simulation allows the modeling of pricing scenarios to forecast business impact. Configurable models include:

- Revenue predictions at set prices based on price elasticity

- Market share changes versus competitor price movements

- Profitability impacts of cost inflation or currency shifts

Simulations enable “what-if” experimentation with pricing levers to optimize strategy before implementation.

Data-Driven Demand Forecasting

Predictive analytics leverage statistical and machine learning models to forecast sales at a given cost. The algorithms ingest historical data to predict future demand. Key model outputs include:

- Unit sales predictions by product at various price points

- Revenue forecasts accounting for product mix

- Order volume predictions across geographies

- Likelihood of backorders or stockouts

Reliable demand forecasts guide cost of selling to align with production capacity and inventory.

Multivariate Price Testing

Multivariate testing evaluates pricing outcomes by adjusting multiple variables simultaneously across buyer segments. For example:

- Testing discount depth, formats ($, % off) and qualifying thresholds

- Testing promotional timing and sequence of promotions

- Testing bundle options and corresponding bundle pricing

The results identify optimal pricing factors for each segment for maximum sales lift.

These advanced analytical capabilities empower strategic, data-driven pricing decisions for higher profitability.

DO YOU KNOW?

In many cases, even the best discount offers do not increase the sales volume in retail. Because of this, constant price analysis can help you understand a customer’s purchasing behavior.

Algorithmic Price Optimization

- Platforms provide data- based cost optimization suggestions to achieve business goals like:

- Profit maximization – Optimal pricing for maximum margin

- Share growth – Penetration pricing to expand customer base

- Excess inventory reduction – Promotional pricing to increase sell-through

- The built-in algorithms calculate optimal prices accounting for all product costs, demand forecasts, and market constraints.

Multi-Channel Price Execution

Analytics tools push optimized pricing across both online and offline channels including:

- Automated pricing updates for eCommerce sites and online marketplaces

- New cost list generation and distribution to sales teams

- POS and checkout system updates across brick-and-mortar retail stores

- Customer-specific catalog and sales material reprints

This ensures unified omnichannel pricing.

Performance Tracking

Post-implementation tracking provides feedback on pricing strategy effectiveness. Key metrics monitored include:

- Sales volumes by product and segment at new price points

- Revenue and margin outcomes from price changes

- Market share shifts relative to competitor reactions

- Cannibalization rates across products or sales channels

The insights further refine and improve performance over time.

With advanced analytics, automation, and real-time tracking, these platforms enable both strategic cost-of-sell optimization and streamlined execution across channels. Leading solutions include:

- Pricefx for large enterprise cost optimization and management

- KBMax for value-based insights for manufacturers

- Perfect Price for eCommerce dynamic pricing capabilities

- And price2Spy for website price tracking and competitive alerts

The combination of data, algorithms, automation, and agility provided by pricing analytics translates into higher profitability through strategic pricing excellence.

Conclusion

The right pricing analytics tool provides the competitive intelligence, predictive insights, and optimization needed to continuously adapt pricing for profitability. Given the speed of modern markets, leveraging software is prudent to stay agile with the cost of goods.

With many options available, companies should assess their pricing maturity, capabilities needed, as well as budget to choose the best solution.

Used right, These tools can drive significant incremental revenue and margin growth. In today’s data-driven business environment, pricing analytics is becoming a necessity rather than a nice-to-have.